Investment Strategies

Capital Preservation

Preservation of capital, current income, and modest growth potential

The Capital Preservation strategy seeks long-term preservation of capital, current income, and modest growth potential.

Potential Benefits

- Low Risk – We invest primarily in high quality, short-term bonds.

- Current Income – We seek higher income over time than bank deposits and cash equivalent investments.

- Modest Growth Potential – The small stock portion of the portfolio can meaningfully add to long-term return.

- Low-Cost Implementation – We use low-cost investments in the portfolio, including index mutual funds and ETFs.

The Capital Preservation strategy pairs the benefits of a short-term laddered bond portfolio—for safety and income—with a small stock component for growth.

The bond allocation represents about 90% of the portfolio and is designed to provide capital preservation and current income. The remaining 10% of the portfolio is invested in stocks for long-term growth. Stock investments carry the higher risks associated with such investments and are expected to achieve a commensurately higher return on average over time.

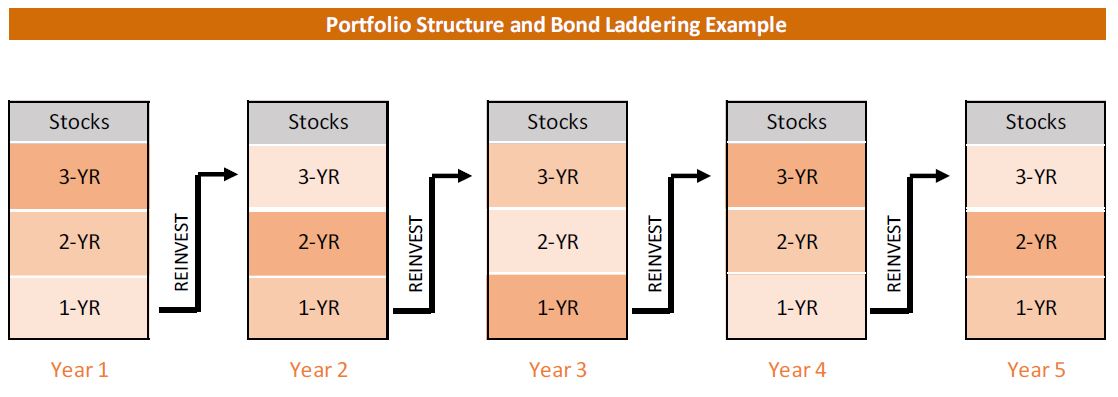

The approximately 90% bond allocation is invested in short-term high quality bonds, including mutual funds and exchange-traded funds (ETFs) investing in such bonds. Bond holdings are laddered; that is, we generally distribute our bond holdings over maturities of 1-3 years and reinvest as bonds mature. (See diagram below.) Short maturity bonds such as these generally experience less price fluctuation in response to changes in market interest rates than longer maturity bonds. Bond sectors may include US Treasury securities, investment-grade corporate bonds, and national and home-state tax-free municipal bonds.

The approximately 10% stock allocation adds diversification and the opportunity for growth. The equity allocation is invested in mutual funds and ETFs holding a diversified portfolio of US large cap stocks, such as an S&P 500 index fund.

Portfolio investments are broadly diversified and liquid, offering easy access to cash when needed.