Investment Strategies

Private Markets

Growth-Oriented Assets Generally Not Traded on Public Markets

The Private Markets strategy seeks high total return from a combination of long-term capital appreciation and current income.

The strategy invests primarily in growth-oriented assets generally not traded on public markets, including privately held companies and real estate. We implement Private Markets portfolios using commingled funds that are diversified across many individual assets.

The Growing Importance of Private Markets

Private markets—the markets for assets not traded on public securities markets—are of growing importance to investors. Consider:

- The number of US companies listed on US stock exchanges has declined by about 28% since 1996.

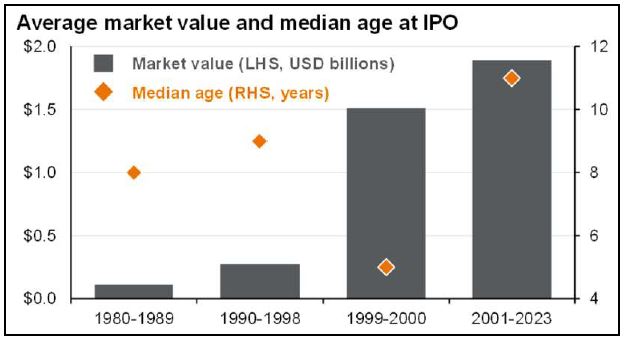

- Companies that ultimately do go public are staying private much longer. In 1999, the average time from technology company inception to IPO was 4 years. Today it is over 11 years. And when they do go public, they are at substantially larger valuations than in earlier periods. Many companies realize their steepest rise in value in the years before they go public.

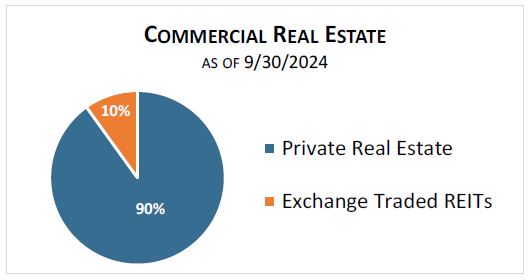

Likewise, more than 90% of US real estate is owned by entities that are not publicly traded.

Investors who overlook private markets may be missing an important opportunity for diversification and potentially attractive

returns.

Source: JP Morgan

Venture Capital

Venture capital represents investments mostly in private companies that have raised capital through venture capital firms. We focus on mid and late-stage venture capital investments where there may be a higher likelihood of realizing capital gain and liquidity over a relatively shorter holding period, either through acquisition by another company or an initial public offering. In venture capital we primarily seek capital appreciation.

Private Equity

Private equity represents investments in private companies that have raised capital through means other than venture capital firms. These companies include both mature businesses with stable cash flow and younger, more rapidly growing firms. Capital gain and liquidity may be realized through a combination of acquisitions and public offerings. We focus on investments in well-established private equity funds where future cash flows may be forecasted more easily than in the case of new private equity funds. In private equity we primarily seek capital appreciation.

Private Real Estate

We define private real estate to include all real estate not owned by an exchange-traded company. We focus on portfolios diversified across commercial, industrial, and multifamily residential properties, with moderate debt levels. In private real estate, we seek total return composed of an attractive current yield and some capital appreciation over time.

Source: Nareit

Risk and Liquidity

The Private Markets strategy generally should be viewed as an aggressive growth strategy with a commensurately high level of risk. The funds in which we invest generally offer limited liquidity at least quarterly, but there can be no assurance that all or any portion of a fund holding can be liquidated in any given period. Accordingly, the Private Markets strategy is designed for long-term investors who can bear both the associated investment risk and potential illiquidity.

For more information on these strategies, please speak with a Gould portfolio manager. Contact Us