Investment Strategies

TargetReturn

Preservation and growth of purchasing power over time

The TargetReturn strategy seeks to preserve and enhance the purchasing power of client assets over time.

We target a long-term average annual return of 2% to 4% above inflation, while taking the least amount of risk necessary to achieve that goal.

TargetReturn is an “absolute return” strategy because its objective is independent of market returns. Clients frequently employ TargetReturn to complement their equity or balanced portfolios, where returns are more linked to the market’s ups and downs. For clients with substantial assets, maintaining purchasing power may be the most important objective of all.

TargetReturn portfolios are constructed from a broad universe of approximately 15 distinct asset classes, including US and international stocks and bonds, precious metals, commodities, real estate and specific industrial sectors. Each asset class is implemented using low-cost, tax-efficient index or index-like mutual funds, including exchange-traded funds (ETFs).

We do not seek or expect our quarterly returns to equal or even necessarily be close to our long-term target. Rather, we believe that the average of many quarterly returns is likely, over time, to approach our target.

We call this concept “convergence,” as shown in the chart.

Note how the portfolio’s expected range of cumulative average return tends to narrow as the time commitment to the strategy increases. As with all long-term investment strategies, we recommend a minimum 3-5 year time horizon for TargetReturn.

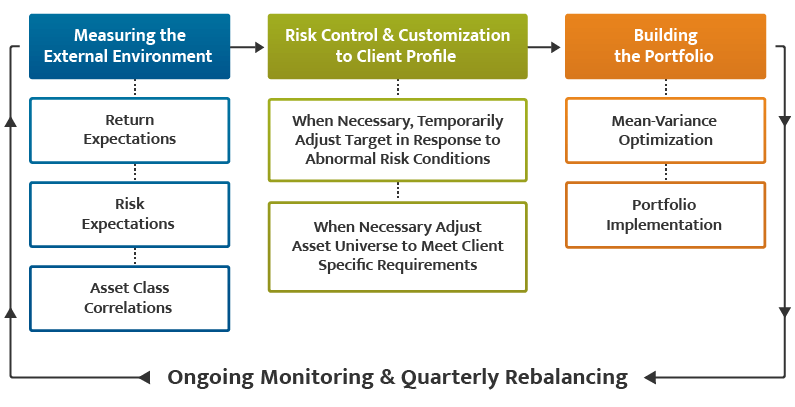

Through portfolio optimization, we update the TargetReturn asset allocation for client portfolios quarterly. Optimization seeks to identify “efficient” portfolio combinations; that is, asset allocations that represent the minimum amount of risk for a given level of expected return, such as our target level of return. Optimization also enables us to make informed decisions about the tradeoff between return and risk at various points in time.

Ready to Talk to Gould?

Experience the freedom of our independent financial advice. Get started today by contacting the Gould Asset Management Team.