Investment Strategies

Overview

Gould Asset Management offers a wide range of innovative investment strategies, designed to meet the diverse needs of its clients.

Every aspect of our asset management is guided by a set of principles, carefully developed through years of experience. These principles form our bedrock in the face of dynamic financial markets. Learn more about our guiding principles.

Gould is different in ways that count. These include the innovative strategies we offer, the tools and methods we use to implement those strategies, and the way we customize our services to meet the needs of each client. Learn more about what makes us different.

Gould Investment Strategies

Core Equity

Equity Index Plus‣

The Equity Index Plus strategy seeks long-run stock market-like returns, with significantly less volatility than the market itself. We offer US, international, and global versions of this strategy.

Balanced

BenchmarkPlus‣

BenchmarkPlus is a dynamic and balanced strategy investing across a broad range of asset classes. We offer a range of risk/return alternatives of this strategy.

Absolute Return

TargetReturn‣

The TargetReturn strategy seeks to preserve and enhance the purchasing power of client assets over time, while taking the least amount of risk necessary to achieve that goal.

Responsible Investing

Summary‣

Gould’s responsible investing strategies seek to achieve positive societal impact and competitive, long-term, rates of return.

Income

Capital Preservation‣

The Capital Preservation strategy seeks long-term preservation of capital, current income, and modest growth potential.

Diversified Income‣

The Diversified Income strategy seeks attractive current income, while providing broad diversification and potential for growth of capital.

Quality Fixed Income‣

The Quality Fixed Income strategy seeks attractive current income and long-term preservation of capital through investment across a broad range of bond market sectors.

Private Markets

Summary‣

The Private Markets strategy seeks high total return from a combination of long-term capital appreciation and current income through growth-oriented assets generally not trade on public markets.

Specialty Strategy

Summary‣

Gould offers specialty investment strategies designed to meet a variety of investment objectives.

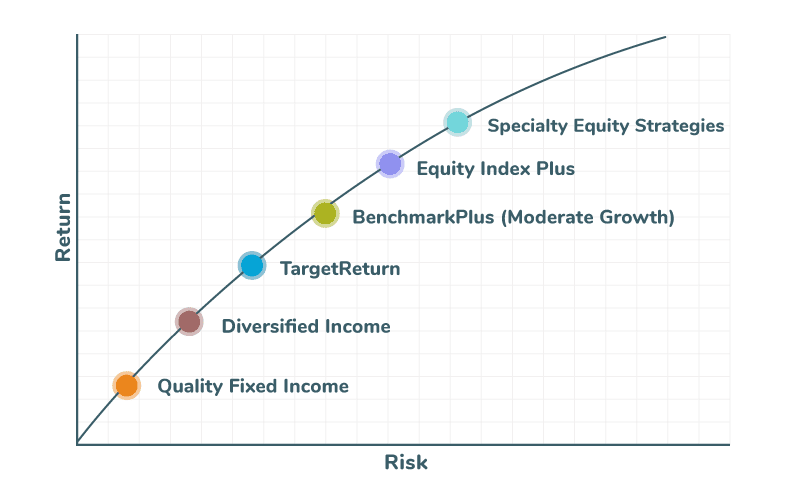

Investment Strategies –

Risk/Return Characteristics

The following chart is a general schematic of the relative risk/return positions of the investment strategies, on average over time.

Risk & return points are for illustrative purposes only and are completely hypothetical. Actual results may vary.