Investment Strategies

Responsible Investing

Values-based investing to achieve positive societal impact

At Gould Asset Management, we have considerable experience in the area of responsible investing.

Responsible investing can take on many forms and many names. Depending on one’s particular emphasis, it can be called values-based investing, socially responsible investing (SRI), green investing, ethical investing, impact investing, sustainable investing, and the list goes on. Regardless of the terminology, the goal of responsible investing is generally the same—to generate long-term competitive financial returns in a manner that provides positive societal impact.

Many of our clients seek to incorporate social considerations into their portfolio and we help these clients work through the process. When we undertake this process, we work closely with each client to understand their values, motivations, and societal goals. It is critical to understand at the outset that each client may have their own unique way of defining and implementing a responsible investment program.

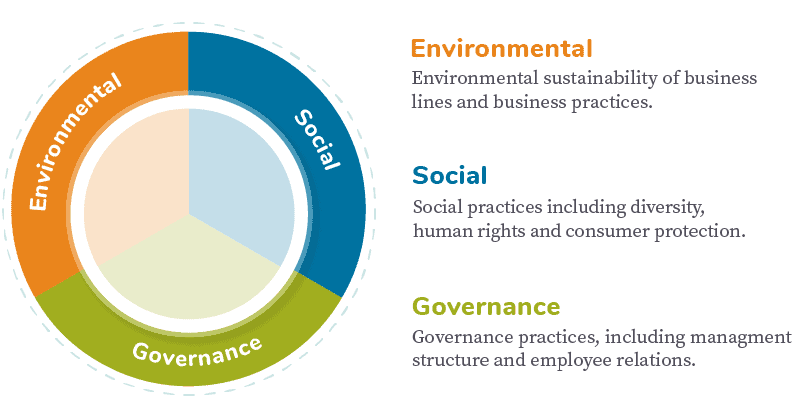

Potential areas of emphasis include environmental, social and governance practices, as illustrated in the following graph.

Key Elements to Responsible Investing:

- Determining which social goals have highest priority

- Identifying the range of investment vehicles that best match those priorities

- Understanding the tradeoffs involved; e.g. potential tracking error versus portfolio benchmark, and/or incremental expenses

Environmental, Social, & Governance

These three areas of Environmental, Social, and Governance practices (often referred to as ESG) encapsulate a wide swath of the responsible investing landscape, and typically serve as a good jumping off point for preliminary discussions of a responsible investing approach. Other areas of emphasis, though, can include:

- Impact investing, i.e., identifying investments expected to yield specific social benefits

- Investment screening to exclude specified industries whose business models run contrary to the client’s social goals

- Socially responsible index funds, including exchange-traded funds (ETFs)

- Actively managed mutual funds

- Portfolios of individual equities managed according to a client-specified set of parameters

Gould’s responsible investing approach is typically overlaid on top of one of our diversified, risk-managed strategies, such as BenchmarkPlus or Equity Index Plus, and can be customized to a variety of return objectives and risk tolerances.

Gould investment professionals work closely with clients to implement a responsible investing program that seeks long-term competitive returns and positive societal impact, and is tailored to each client’s unique goals and values. To begin a conversation on how we might help you achieve your responsible investing goals, please contact a member of our portfolio management team.

Ready to Talk to Gould?

Experience the freedom of our independent financial advice. Get started today by contacting the Gould Asset Management Team.