by Donald Gould

A Growing, Slowing Economy

On the financial and economic front, this fall’s colors are a bit of kaleidoscope. It’s an odd time in the economy, with seemingly contradictory indicators coming from various directions. On the plus side, the consumer side of the economy still seems in reasonable shape. In September, US unemployment reached its lowest point (3.5%) since Richard Nixon was President. Jobs seem plentiful. But not all jobs are created equal, and 3.5% today probably means something quite different from what it meant in 1969. Many of today’s service jobs[1] lack the stability and financial benefits[2] of, say, a 1969 factory job. Wage growth remains lackluster.

At the same time, cautionary signs abound. Manufacturing is contracting, construction activity has leveled out, and jobs growth is slowing. Residential real estate prices are softening in some of the highest income markets, including New York City and Silicon Valley. Overseas, both developing and emerging economies look sluggish at best, exacerbated by rising tariffs and slowing trade. Interest rates, the most important financial indicator of economic health, dropped further in the third quarter, and short-term rates remain at or above long-term rates, reinforcing the perception of a slowing economy and rising odds of recession. Fully two-thirds of Eurozone debt now carries a yield below zero. Not surprisingly, inflation remains subdued.

DC Political Landscape Further Unsettled

And then there’s politics. We venture into a political discussion with all the enthusiasm of hiking through a field of unexploded mines, but there’s no ignoring recent developments in the US political picture. The House has commenced an impeachment inquiry into President Trump, centered on activities related to Ukraine and former Vice President (and current presidential candidate) Joe Biden. Meanwhile, the latest Democratic Party debate sports twelve contenders for the nomination. The upshot of all this is that there is more uncertainty surrounding the 2020 presidential election.

Conventional wisdom says some candidates will be better for the stock market than others. In our experience, presidential elections rarely have such clear-cut impact, but these kinds of considerations will likely contribute to market volatility as the elections approach next year. That said, we would counsel investors to keep their focus on the long-term and not get caught up in the inevitable punditry. Divining either the outcome of political races or the market impact of those outcomes is a notoriously difficult business.

Financial Markets Still Robust, Bonds Especially

The stock market’s third quarter performance reflected both the economic and political uncertainties, as major US indexes oscillated over a 7% range and ended the quarter about where they began. Thanks to a spectacular first two quarters, the market’s year-to-date returns remain very strong, but considering the sharp decline in 2018’s first and fourth quarters, US markets are essentially flat over the past 20 months, while major foreign indexes are meaningfully down.

The stock market’s third quarter performance reflected both the economic and political uncertainties, as major US indexes oscillated over a 7% range and ended the quarter about where they began. Thanks to a spectacular first two quarters, the market’s year-to-date returns remain very strong, but considering the sharp decline in 2018’s first and fourth quarters, US markets are essentially flat over the past 20 months, while major foreign indexes are meaningfully down.

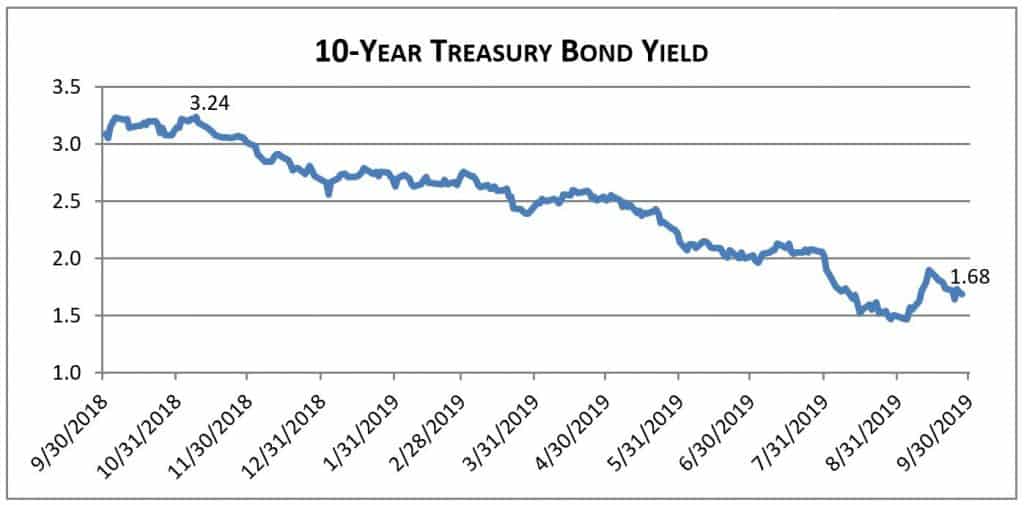

Bonds have benefited greatly from falling interest rates, which began a steep decline in last year’s fourth quarter as markets detected the first hints of global economic slowing. The yield on the benchmark 10-year US Treasury note descended from its 3.24% peak in early November 2018 all the way down to 1.68% at the end of September. Recall that prices of existing bonds go up when market yields fall— yesterday’s 3% bond is worth much more when today’s bond only pays 2%. Long maturity bonds will move up the most since their higher interest payments will last longer.

The leading US bond index returned 2.3% in the third quarter and 8.5% year-to-date. These returns are way above the bonds’ interest income and can only be sustained by further drops in market interest rates. Nothing says rates can’t go lower—with the advent of negative interest rates, perhaps they can go lower than we’ve imagined. But one shouldn’t count on continued outsized returns from the conservative side of the portfolio.

Brokerage Price War Enters New Phase

On October 1, Charles Schwab triggered the latest round of the brokerage industry price war, dropping commissions on stocks and exchange-traded funds (ETFs) to zero. Fidelity, TD Ameritrade and others quickly followed suit. This will benefit our clients by further reducing the already relatively small amount devoted to brokerage commissions.[3] The move will also surely accelerate the trend toward ETFs and away from traditional mutual funds. ETFs may even become the vehicle of choice for cash equivalents in many circumstances.

[1] For example, driving Uber or waiting tables.

[2] For example, the near-extinct defined benefit pension plan.

[3] Options and certain traditional mutual funds will continue to carry small transaction fees.