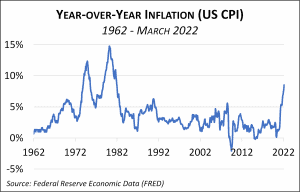

Inflation is Here

Inflation is now at levels not seen in 40 years, thanks to a perfect storm of events. First, governments countered the Covid pandemic with massive fiscal and monetary stimulus, pumping up consumer demand and tightening labor markets, both inflationary. The pandemic also caused long-lasting disruptions in supply chains. Now, in the wake of war in Ukraine, energy and food prices have spiked further.

The Federal Reserve has responded to inflation with a U-turn on monetary policy, raising short-term interest rates and likely soon reducing its bond holdings, which puts upward pressure on longer-term interest rates, as well. The Fed will try to engineer the proverbial “soft landing,” applying the brakes enough to tamp down inflation, but not so hard as to throw the economy into recession.

It will be a challenge for the Fed. Higher interest rates—intended to restrain demand—will be countered by flush consumers and pent-up demand. And Fed policies can’t help at all on the supply side. Most of all, the Fed needs to combat inflation expectations that can ingrain a self-reinforcing cycle of wage and price increases.

Recession Ahead?

Talk of economic recession is suddenly everywhere. Possible triggers include the Fed’s tightening, rising prices that sap consumer sentiment and buying power, and global uncertainty surrounding the war in Ukraine. Countering this view is today’s reality—consumers spending freely, a robust jobs market, and rising wages.

Ordinarily, we would put low odds on imminent recession. However, some of us remember when Fed Chair Paul Volcker jacked up short-term interest rates to near 20% to break the inflationary psychology of the late 1970s. Recession then was unavoidable. We don’t yet know what level of interest rates will be required to change today’s mindset.

The Treasury yield curve has flattened and even inverted in some places, meaning shorter-term interest rates exceed longer-term rates, historically a harbinger of recession, though not always so. Some help on the supply side—more people entering the workforce, easing of supply bottlenecks—could dampen inflationary pressures. Fingers crossed on that score.

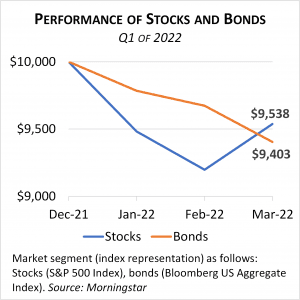

Stocks and Bonds Decline in Concert

After nearly 13 years of mostly rising stock and bond prices, it’s easy to forget that financial markets can go down, as well as up. In most environments, stocks and bonds tend either to move inversely to one another or not correlate much at all, steadying overall portfolio returns. However, with both stock and bond prices falling in the first quarter, investors had few places to hide. Both aggressive and conservative portfolios declined similarly.

It’s never pleasant to see lower numbers on our quarterly statements, but as always it helps to put the numbers in perspective. The S&P 500 benchmark stock index ended the quarter at a level that represented an all-time high as recently as November of last year. Likewise, the recent spike in the 10-year US Treasury yield takes it back only to levels seen repeatedly over the past decade.

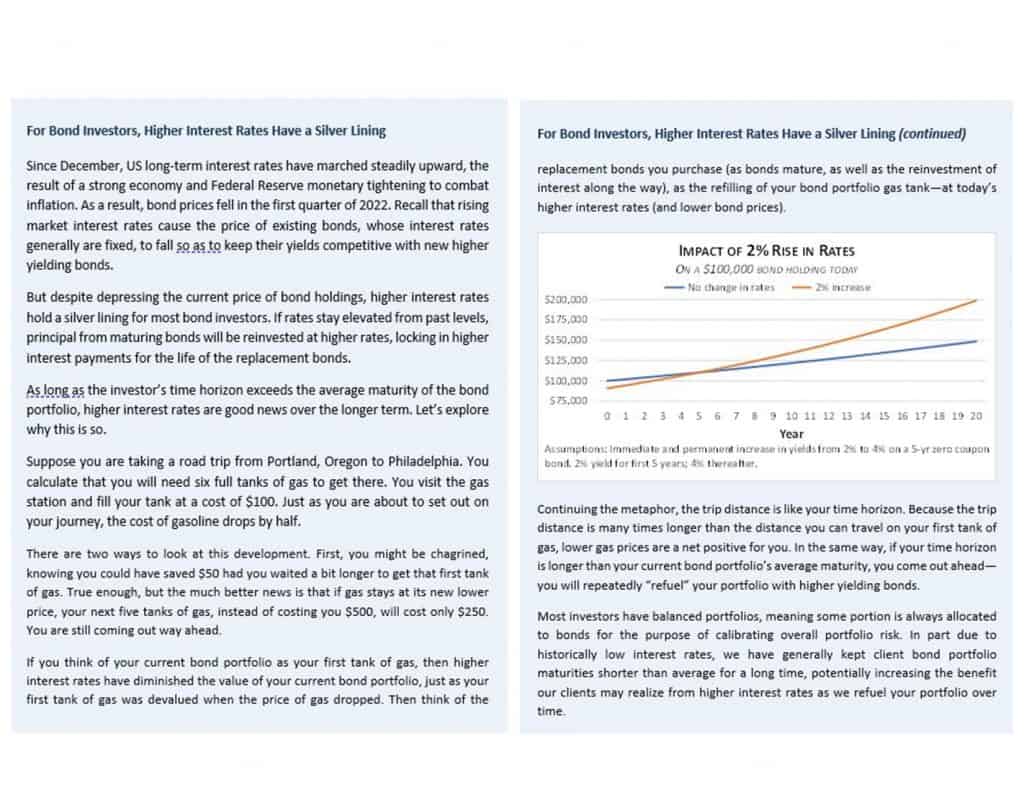

However, inflation, both current and projected, is running at a rate not seen in a very long time. Left unchecked, inflation is a serious problem for financial markets. Fortunately, the Fed appears seriously committed to fighting inflation, even at the cost of near-term economic and market pain. Meanwhile, we remind clients that growth-oriented assets such as stocks and real estate eventually adjust to inflation. And as discussed in a separate note in this quarterly report, higher interest rates are mostly good news for bond investors, even though they depress the price of current holdings. Even cash holdings will soon be paying a positive interest rate again.

What we are experiencing today in financial markets is not unprecedented. With calm, discipline, and some adaptation, investors should expect to meet their long-term goals. It’s our privilege to be your guide and companion on this journey.