We hope this note finds you well. 2025’s home stretch is already upon us.

A Dash of AI Makes for a Strange Economic Brew

The US economy finds itself in a most unusual place. The normal correlation between economic growth and a vibrant jobs market seemingly has disappeared. By most measures, the US economy is expanding at a healthy clip, even faster than its average 2% real (inflation-adjusted) growth rate of the past quarter century. At the same time, jobs growth has slowed to a trickle, with only 22,000 jobs added in August.

AI (artificial intelligence) might explain some of the disparity, in multiple ways. First, massive spending in AI infrastructure (chips, data centers, power facilities) boosts the economy, even while the long-term return on that investment remains uncertain. Second, AI may be fueling productivity gains (higher output per hour worked), meaning some combination of increased growth and reduced employment. Walmart recently forecasted a flat employee count over the next three years, saying it expects AI to affect “literally every job” at the company.

The Federal Reserve last month made its first interest rate cut since the end of 2024, seeing the jobs market challenge as more urgent than subduing inflation, which stubbornly remains above the Fed’s historical 2% target. While lower interest rates tend to stimulate asset prices, it is less clear they will spark jobs growth, especially if AI is the main obstacle to more jobs. We should know the answer soon enough.

Perhaps the current disconnect between economic expansion and employment growth is transitory. Alternatively, it might be the first tangible sign of something AI futurists have long foretold—a world of both rapid economic growth and burgeoning unemployment. Such a world would present significant political and societal challenges.

Notable Market Signposts

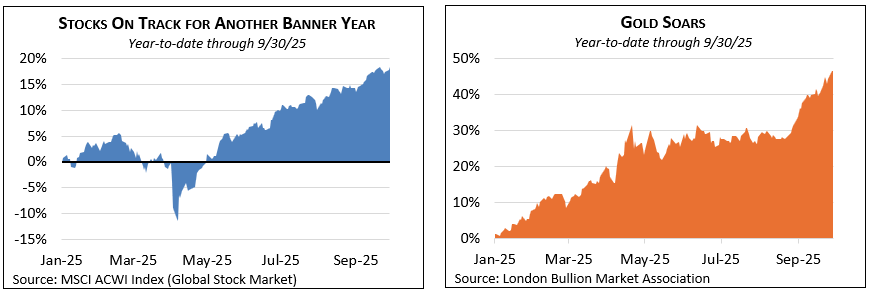

S and international stocks jumped again in the third quarter, with the global equity benchmark rising about 8%, putting markets on course for a third consecutive calendar year of returns substantially above long-term historical averages. For the year to date through quarter’s end, the benchmark S&P 500 was up nearly 15%, while foreign markets returned more than 25%.

And then there’s gold. Alternately labeled a store of value and a barbarous relic, the precious metal is up nearly 50% this year. Remember that gold is an investment that pays no interest or dividends, has no earnings per share, and has real but limited industrial applications. Hence, holding gold entails a significant cost of foregone opportunities. But gold also has managed to maintain its value as a safe-haven “currency” through the centuries, while empires come and go.

We do not see any way to couch gold’s recent ascent as positive news, other than that most of our clients hold some gold in the portfolios we manage. Rather, it is an indication that at some level, even amid a continued bull market, investors are worried. Most likely, they are worried that unsustainable growth in government debt worldwide will threaten the purchasing power of conventional currencies. The tenuous state of today’s politics no doubt intensifies these concerns.

Stock markets are telling a story of optimism, while gold’s message is one of caution. Both can be valid. For a more detailed discussion, be sure to see our quarterly Economic and Market Review that accompanies your quarterly report.

Gould Reaches $1 Billion in Assets Under Management

Last year marked Gould Asset Management’s 25th anniversary, and this year saw us reach another milestone: $1 billion in assets under management! We surpassed that very round number in early September, thanks to continued strong investment returns and new client assets. This accomplishment is only possible because of you, our clients. You have our most heartfelt thanks.

For a fuller discussion, be sure to see our Q3 Economic & Market Review.