Week 4 of the COVID-19 market upheaval witnessed continued high volatility and lower prices. The S&P 500 fell nearly 15%, with this past Monday’s drop accounting for about 80% of the weekly decline. From its peak, the index is down 32%, taking it back to levels last seen around the beginning of 2017.

The week also saw a rush to cash by some institutions and individuals. At various points, almost all assets—from the safest to the riskiest—were falling in concert, something that rarely happens. Yes, stocks sold off, but so did US Treasury bonds and gold. We suspect that much of this was initiated by businesses and others trying to build up a cash reserve to meet upcoming expenses, especially debt payments, payrolls, rent, and other non-discretionary items.

Life Up Close…

As tumultuous as the week was in financial markets, it’s safe to say the bigger shocks were felt in our everyday lives. By week’s end, all of California’s 40 million residents (and about 1 in 5 Americans nationally) were in lockdown mode. Suddenly, we are physically separated from loved ones, neighbors, co-workers, and friends, while we carefully navigate formerly trivial tasks such as stocking groceries.

Up close and personal, it’s undeniably a stressful and anxious time. When it comes to our investments, the challenge is to find a way to keep today’s emotions from derailing well considered long-term plans.

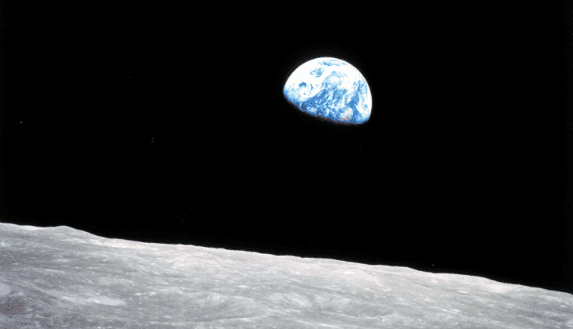

…and from a Distance

Try this thought experiment. Imagine you are standing on the moon right now, looking towards Earth. What do you see? Through a very powerful telescope, you spot an unusual degree of commotion in population centers and even great upheaval in individual lives. But to the naked eye, the planet looks to you as it always has.

You are told about COVID-19—all the statistics, projections, and uncertainties. Now you are asked, in light of this, what does the future hold? Specifically, what does the future hold over the longer timeframes relevant to most investors?

Stepping away from your telescope, you might reasonably say this:

- The COVID-19 pandemic resembles a natural disaster, like a global hurricane or earthquake.

- The disaster causes a sudden and sharp dislocation in everything, including economies and financial markets.

- Sooner or later, COVID-19 will run its course, as all previous pandemics have. In a matter of weeks or months (possibly many), recovery will begin.

- The long-term productive capacity of Earth’s population, as well as its demand for goods and services, is not likely altered in any significant way by the current crisis.

- Economies and markets will therefore recover, though the timeframe is uncertain.

Some Fallacies

Here are a few mental traps to avoid!

“Everyone’s selling.”

Actually, no. For every seller moving to cash, there is a buyer more than happy to exchange cash for positions in long-term investments at prices the buyer views as attractive. Shares of Apple trade at a lower price than a month ago, but the number of shares owned has not changed, just the identities of the owners.

“The market’s down a third.”

Yes, measuring the decline from its all-time high reached February 19, an arbitrary point that maximizes the measured decline. Calculated from the end of 2018, the market is down only about 7%, including dividends received. Measured from 1926, the market has returned about 654,000%. (That’s not a typo.) For any investor living today, the relevant starting point for considering past performance lies somewhere between 1926 and last month. Don’t let headlines make you think otherwise.

“The market’s down a third and so am I.”

No, you’re not. Almost all portfolios are balanced between stocks, bonds and other assets. While the stock portion of a portfolio might be down a third from its peak, whole portfolios are generally down much less. This is not a fortunate accident, but rather the result of careful design. We knew a bear market would come at some point. We didn’t know when and we surely didn’t know a virus would be the catalyst, but bear markets will always be a fact of stock market life.

Think Like a Real Estate Investor, Not a Stock Trader

Warren Buffett frequently reminds us that owning stocks is not a wager on their near-term direction, but rather a long-term investment in enduring businesses. In some ways, the stock market and modern technology have teamed up to distract us from this vital point. Together they tempt us to focus, second by second, on what we would realize if we sold at that moment, which is exactly the wrong way to think about our portfolios.

We often counsel clients feeling on edge to think about their portfolios more the way they might view a real estate holding. Real estate investments typically are made for long periods, years or even decades. Their price goes up and down, but owners tend not to worry about the fluctuations for several reasons. First, no one knows the true price of a piece of real estate until a transaction is completed. Second, even an estimate of today’s price isn’t important for an asset that will be held for many years to come. Third, real estate is much less liquid than, for example, stocks. Selling a property involves a lot of time, effort, and transactions cost. All these factors combine to make people generally less anxious about their real estate than about their stock portfolios.

Thinking of your portfolio the way you think about real estate not only might help you feel calmer. It’s also the right way to think about it—a long-term investment made to meet long-term goals.

Questions We’re Getting

How far down will the stock market go, and when will it reach bottom?

We don’t know and neither does anyone else. The market could be bottoming right now or it could continue lower. Bottoms are never obvious when reached but are only seen with the benefit of hindsight.

The average bear market in the post-WWII period has taken about five months from peak to trough, with an average decline of just over 30%, right about where we are now. The average gain over the 12-month period following the trough has been nearly 40%. There is substantial variation around these averages.

Expect the rough ride to continue this week and perhaps for quite a while, but remember that this, too, shall pass.

What actions is Gould taking in client portfolios?

In BenchmarkPlus portfolios, we will generally rebalance portfolios in a disciplined manner when the stock/bond mix deviates significantly from our target asset allocation. For example, if the stock market decline pushes a client’s stock allocation percentage far below our target, we will move the portfolio back towards target by selling some of the assets that have performed better (for example, bonds) and investing the proceeds in stocks. Often, this is the last action one feels like taking at the time, but rebalancing has proven to be a reliable way to improve long-term performance.

In all portfolios, we are closely monitoring risks and opportunities across the whole range of asset classes.

We see the number of COVID-19 cases growing daily. What does this mean for markets?

Markets generally are pretty efficient when it comes to reflecting in current prices what is already known. In other words, markets already know that there will be many more cases, that unemployment figures will spike, and that the economy is contracting. This information is already incorporated into today’s stock and bond prices. From this point forward, COVID-19 will move markets (up or down) only to the extent that future developments are better or worse than what is now anticipated.

Is there any good news out there right now?

We think so.

China has shown that strict social distancing measures can swiftly blunt the rate of transmission. Daily new cases in Wuhan reportedly have dropped to zero. The adoption of this policy in the US and elsewhere is cause for encouragement.

Test kits are becoming more widely available.

Researchers worldwide are working to identify effective treatments for those with COVID-19. They are also developing and testing vaccines for the virus.

Businesses seem finally to be mobilizing to produce more masks, ventilators, and other badly needed items.

Governments are moving to provide substantial financial help to households and businesses. Meanwhile, central banks are supplying the liquidity necessary to keep the financial system operating.

How is the situation affecting Gould’s operations?

At Gould Asset Management, we have moved mostly to a teleworking arrangement without missing a beat. We are finding team videoconferencing to be a great way to collaborate as if we were in the same building. We are keeping in close contact with clients, using both phone and video calls. If we haven’t reached you yet or if you have other questions, please don’t hesitate to phone or email and we’ll quickly find a time to chat. We’ll be here for you for the duration of this crisis and well beyond.