Having penned these quarterly letters for the past two decades, we cannot recall a time as…as…as what? As remarkable? As eventful? As challenging? Take your pick, but let’s just settle on…extraordinary.

America has just concluded a year that defies description.

The Covid pandemic took hold in late winter and dominated all our lives, tragically so for the more than 375,000 dead and their loved ones. The near miraculous rapid development of effective vaccines gives us hope that life could return to a semblance of normal in a matter of months. But in the meantime, the virus rages on and the daily statistics remain grim.

Over the summer the country was racked with unrest over racial justice, triggered by the police killing of George Floyd in Minneapolis. We still have a long and hard road ahead to realize our aspirations of liberty and justice for all.

Here in the west, California and other states suffered horrendous and destructive wildfires, further evidence of the dangers posed by climate change. If you happened to be in the San Francisco Bay Area on September 9, you could be excused for thinking that Biblical plagues had descended upon us. The sky took on a surreal dark orange hue that no words can capture. Even at midday, the landscape was dimmer than after sunset on any other day.

The year concluded with the election of a new president, Joe Biden, and a subsequent two-month effort by President Trump to discredit and overturn the result. Congress ultimately confirmed Biden’s election, but not before a mob laid siege to the Capitol in Washington, DC on January 6.

If 2020 has left you feeling wrung out, you are not alone. We hope 2021 brings consolation, recovery, healing of division, and renewed optimism about our collective future.

Extraordinary Markets, Too

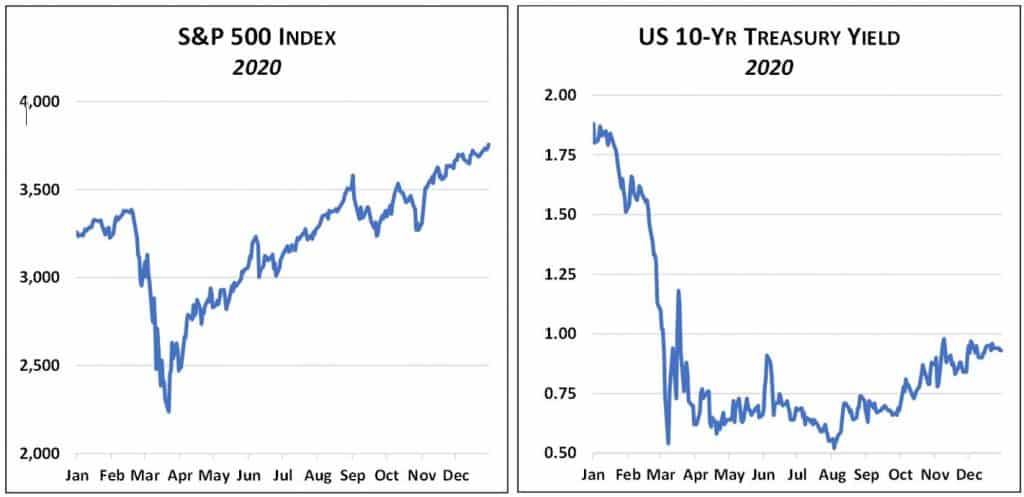

The pandemic triggered one of the steepest—and briefest—bear markets in history in February and March, followed by a mindboggling ascent. The S&P 500 fell 34% in five weeks from its high in February, only to climb 68% from its March low, ending the year at an all-time high. The index returned a remarkable 18.4% for the year, a result that confounds many observers in the face of 2020’s myriad challenges, not least of which is massive business disruption and unemployment that persists to this day. Many factors might explain the historic rebound.

The stock market’s shift from bear to bull market was sparked by massive government relief packages and central bank intervention. Beyond stimulating the economy, a meaningful portion of the pandemic-driven multi-trillion-dollar government infusions made its way into financial markets, pushing up the prices of both stocks and bonds.

While the pandemic did not create the online economy, it greatly accelerated the transition in that direction. In the process, some parts of the economy—think online retailers, videoconferencing providers, and suburban homes—were huge winners, while other parts—shopping malls, airlines, and office towers—were losers. Revenue shifted away from low profit margin, high employment industries in favor of high margin, lighter staffed businesses. To give a stark example, the technology sector accounts for just 2% of total employment, but a whopping 38% of the market value of the S&P 500.

Note that interest rates also plunged with the pandemic’s onset. The 10-year US Treasury yield fell from 1.92% at year-end 2019 to a miniscule 0.54% at one point in March, before ending the year at a still historically low 0.93%. The benchmark Fed Funds rate was cut from about 1.5% to near zero, where it remains today. Recall that other things being equal, lower interest rates push up the price of stocks by reducing the relative attractiveness of alternatives such as bonds.

More recently, the wonderful news about the efficacy of multiple Covid vaccines has helped power the market higher. Most market analysts anticipate a major economic and earnings rebound as the vaccines are rolled out more widely, case counts fall, and life gradually returns to normal. Here’s hoping.

As we have discussed at more length elsewhere, the stock market is essentially just a machine that estimates the present value of future corporate profits. The market passes no judgment on the size of those profits, the division of the spoils, or even the system of government under which they are achieved. Those are matters of the political realm.

We are left with the incongruous result that we finished 2020 with both a higher stock market and substantially greater misery across the economy in the form of higher unemployment and poverty levels.

Market Froth – Tesla and Bitcoin

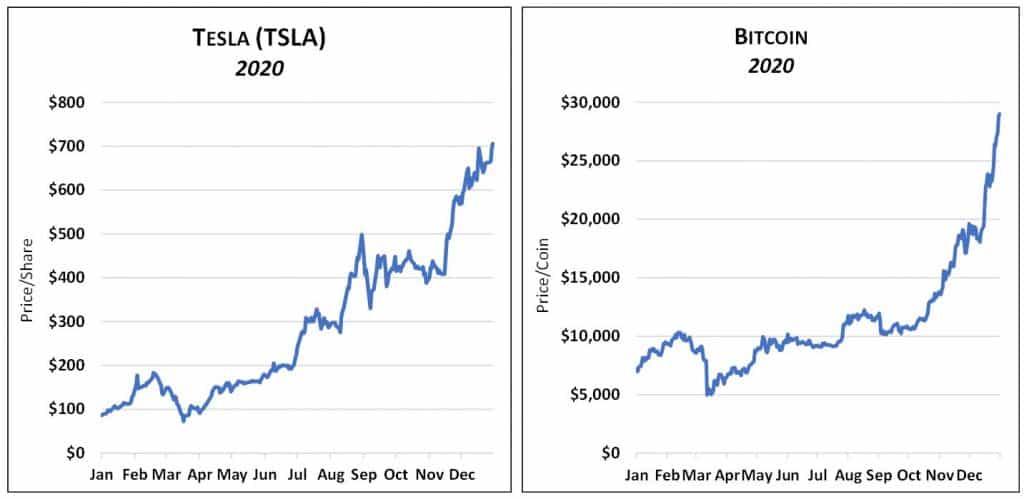

The stock market’s recovery from its March lows included some sure signs of speculative excess. Front and center is the case of Tesla, whose eccentric genius founder Elon Musk is now the world’s wealthiest person, besting even the likes of Amazon’s Jeff Bezos. Tesla began 2020 at $83.67 per share and finished at $705.67, a 743% climb. As this is written in early January, the stock has gone “asymptotic,”[1] that is, rising almost vertically on a chart, now at well over $800 per share. With a market capitalization of almost $800 billion, the market is valuing Tesla at more than $1.5 million per annual vehicle sold. In sharp contrast, GM is valued at less than $10,000 per car. Yes, Tesla is more than a car company, but this still looks like a bubble of major proportions.

Bitcoin, the leading cryptocurrency, is another case in point, having started 2020 at around $7,000 and climbing at an accelerating rate throughout the year, finally going asymptotic in late December and touching $40,000 in the past few days. Putting a value on Bitcoin is even harder than Tesla, but the price increase again is indicative of the fever that overtakes financial assets periodically.

Even broad market benchmarks, fueled by the extraordinary performance of growth stocks, are showing signs of froth. Consider that the S&P 500’s 68% rise from its March lows to year-end compressed six years of average market performance into just nine months.

We sense a connection between the pandemic and the “animal spirits,” as British economist John Maynard Keynes described such investor mania. Lockdowns, smartphone trading applications, and social media have mixed to form a volatile brew.

We are not declaring a generalized market bubble (though some leading thinkers

are) and in any case, timing the end of a bubble is impossible. A bubble can

grow and grow and grow, deflating only when sentiment shifts. The one defense

against a potential market bubble is having the discipline to stick to one’s

long-term plan and not let greed or the fear of missing out dominate your

thinking. An important form of discipline is periodic portfolio rebalancing,

regularly selling some of those assets that have risen the most and allocating

the proceeds to those that have lagged. This practice keeps the portfolio from

drifting to a higher risk level than intended.

[1] Think way back to your high school geometry course when you learned about parabolas, ellipses, and hyperbolas, the latter of which in some cases rise so steeply that they nearly parallel a vertical line known as the asymptote.