Markets Dip in Third Quarter

The third quarter saw stocks and bonds both decline in the face of continuing Fed tightening. Inflation is down sharply from its 9% peak in mid-2022, but at 3%-4% it’s still above the Fed’s 2% target. So, rather than taking a relaxing summer at the beach, the Fed instead reiterated its intent to inflict still further pain on borrowers, which is how the central bank seeks to slow the economy and rein in inflation.

Rising interest rates pushed down the price of existing bonds, resulting in about a -3.2% return for the leading bond index. Higher bond yields also mean more competition for stocks—the leading global equity index was down a similar -3.3%.

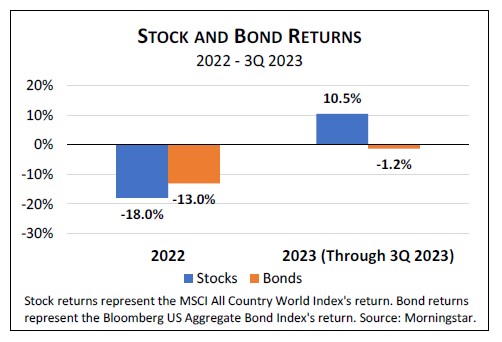

Still, 2023 has been a huge improvement over 2022. Again, it starts with bonds. We noted in January that by entering 2023 with significantly higher bond yields, bond investors had an important cushion should interest rates continue upward. Rates have indeed climbed further this year, but the year-to-date total return on bonds is about -1.2%; not wonderful, but leaps and bounds ahead of 2022’s record setting -13.0% loss. Likewise, even after the third quarter’s pullback, stocks closed the quarter up 10.5% year-to-date, as compared to 2022’s drubbing—an 18.0% decline.

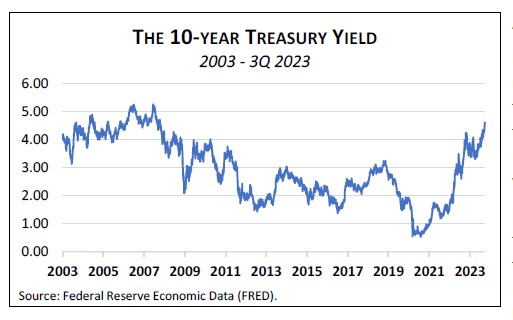

As we enter the fourth quarter, longer term interest rates have moved higher, with the benchmark 10-year Treasury yield approaching 5%, levels last seen in 2007. Higher long-term rates could mean that investors expect the Fed to keep short-term rates higher for a longer period than previously anticipated. Higher rates might also reflect the market’s concern over the large additional borrowings the Treasury must undertake to finance big budget deficits for the foreseeable future.

A Silver Lining for Bond Investors

Higher long-term interest rates are good news for some and bad news for others. Borrowers are hurt the most. Higher rates increase the cost of financing any purchase, from home mortgages to car loans to credit card balances. Real estate investments, because they are usually financed with substantial mortgage loans, are particularly vulnerable to higher rates.

In contrast, clients with bonds in their portfolios benefit in the longer term from higher interest rates. Yes, it’s true that a jump in rates tends to push down the price of existing bonds. But if the average maturity of your bond portfolio is shorter than your investment time horizon (which describes almost all our clients), then the short-term decline in bond prices will be more than offset over time as bond interest and principal is reinvested at higher interest rates. And if the long-predicted recession finally materializes, high quality longer bonds should appreciate, providing a portfolio hedge.

Cash is alluring today with Treasury bills now paying over 5%. But as discussed in our recent blog post, rearranging a long-term asset allocation strategy to try to grab some short-term yield is historically a losing strategy. Remember—by definition, attractive short-term rates can only be locked in for the short term.

Stocks Outlook Hazy

Much less clear is the impact of rising interest rates on stocks. As a rule, higher returns on bonds push stock prices down to a level that makes stocks’ expected return competitive again with bonds and worth the extra volatility stock investors must shoulder.

Various measures show stocks to be expensive relative to bonds, based on historical averages. This does not, however, mean that stocks must go down. We have observed that stocks can remain “expensive” for a very long time, or even get more expensive. Alternatively, stocks can mark time while corporate earnings grow with the economy, making stock valuations gradually more attractive over time.

Whatever its near term course, stock market timing is hazardous. Even when an investor manages to sell before a drop, there is still the question of when to repurchase. In our experience, these investors rarely get back in before a recovery begins, and in most cases not until long after the upswing is underway.

For a fuller discussion, be sure to see our Q3 Economic & Market Review.