The first quarter of 2025 was unlike any we have experienced. The second Trump administration shattered more norms more rapidly than almost anyone could have imagined. In just over two months we have witnessed the upending of longstanding international alliances through a variety of actions. New tariffs on goods imported from our biggest trading partners, a perceived backtracking of US security guarantees in Europe, and an expressed desire for US annexation of Canada and Greenland are among the headliners. However one may judge these, all will agree we are suddenly living in a changed world, one much different than the post-World War II international order we all grew up with.

Tariffs and Other Storms

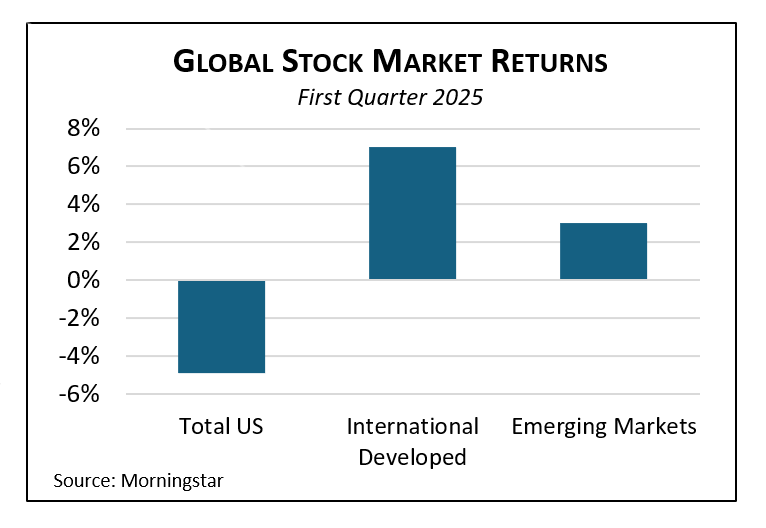

Financial markets reacted negatively, with US stocks substantially underperforming the rest of the globe. The slide accelerated dramatically with President Trump’s April 2nd announcement of unexpectedly large across-the-board tariffs. After dropping 4.3% in the first quarter, the S&P 500 plunged another 10.5% in the two days following the latest tariffs statement. Facing a global stock market rout, a worrisome rise in long-term interest rates, and a weakening US dollar, one week later the president abruptly paused a portion of the tariffs on most countries, and stock markets soared for a day. The US and China remain locked in an escalating trade war, with reciprocal tariffs potentially more than doubling the cost of imports between the two countries.

Tariffs act as a tax on consumers and businesses, reducing economic activity and raising prices at the same time. A slowing economy dents corporate earnings, while higher inflation reduces what investors will pay for those earnings. Both weigh on stock prices. Economists and markets are placing higher odds on a near-term recession in the wake of the new tariffs, though the odds fluctuate with each presidential social media post.

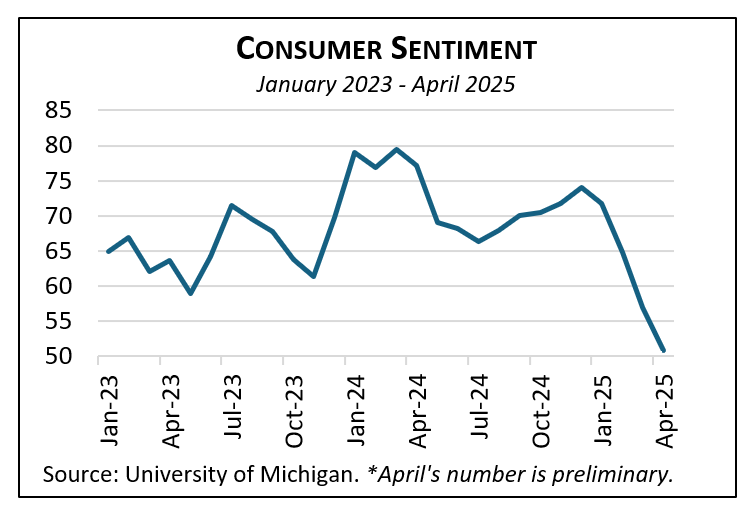

The Fed finds itself in an awkward spot, its hands somewhat tied. The prospect of tariffs challenges both elements of the central bank’s dual mandate of price stability and economic growth. Cutting rates might offset some economic drag from the tariffs, but could worsen the already challenging inflation picture. On balance, recession fears seem to predominate now, with markets now forecasting up to a one percentage point cut in short term rates over the remainder of the year. Well before April’s tariff pinball, consumer sentiment showed a sharp decline in the first quarter.

While our focus understandably is on the financial side of things, we must also acknowledge the unprecedented disruption of the domestic landscape. Multiple US government agencies have been effectively eliminated, while many others are being quickly downsized. Countless new court cases are adjudicating disagreements about the limits of the executive branch’s power within our constitutional system. And there are other shocks to the system too numerous to list. All this has happened less than three months into the new administration’s term. Volatility may be a way of life for some time to come.

Navigating a Whirlwind of Change

We would like to tell you what these tectonic shifts will mean for the world and particularly its financial markets, but there is no road map to consult about the speed and magnitude of change we are experiencing. Investing is about making rational decisions in the face of uncertainty. For us, that means continuing to rely on our investment discipline—principles such as diversification across asset types and regions, asset allocation consistent with client risk tolerance, and periodic portfolio rebalancing.

With great change comes heightened uncertainty about the future and, by extension, elevated investment risk. We are carefully considering the investment implications of the current upheaval and adjusting portfolios as we see appropriate. We are also taking a measured approach. On a boat in a storm, jumping overboard is rarely a sound response.

As always, we are here for you.

For a fuller discussion, be sure to see our Q1 Economic & Market Review.