We hope this note finds you in summer relaxation mode. We could all use that right now.

Living in Interesting Times

The US experienced a consistently eventful second quarter, offering little respite from the tumultuous first quarter. President Trump’s on-again-off-again tariffs dominated the news in April. Financial markets plunged on the April 2nd implementation of new tariffs, but the president reversed course a week later and markets quickly recovered. Immigration was the top story in May as the president ordered stepped up deportations of undocumented residents, which became a focus of nationwide protests in mid-June. Conflict between Israel and Iran then took center stage in late June, culminating with President Trump’s decision to launch strikes on three Iranian nuclear enrichment facilities. Many other news items simmered in the background throughout the quarter.

Exuberant Markets, Especially Abroad

Mostly ignoring the news cycle, the US stock market finished mid-year at record highs, US bond markets stabilized as Treasury yields settled well below their 2024 year-end levels, and a certain exuberance seemed to possess financial markets as we finished the second quarter. Economic news is mostly supportive. Unemployment remains low, inflation is only a bit above central bank targets, consumer sentiment is improving, and the corporate earnings outlook is positive.

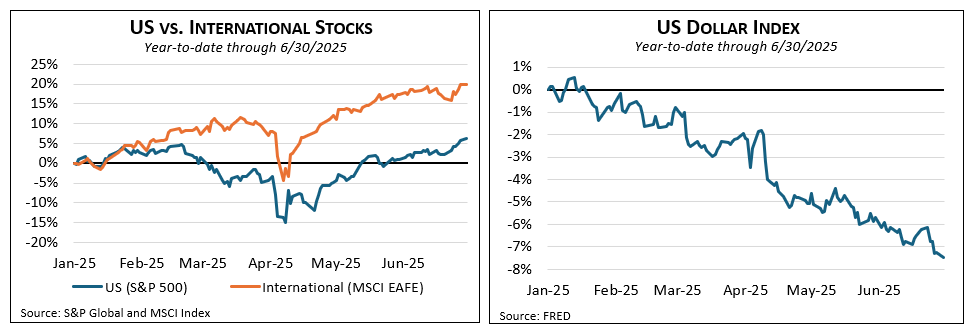

Despite high volatility in April, year-to-date US stock market performance finished slightly above historical averages. However, the US trailed international markets by a wide margin in the first half. The MSCI EAFE index of international developed markets stocks soared 19.9% in the first six months of 2025, outpacing the S&P 500 index’s return of 6.2% for the same period. A good portion of that difference is the result of a 7.5% decline in the US dollar this year, but international stock markets outperformed the US even without adjusting for currency moves.[1]

[1] Dollar weakness—meaning a unit of foreign currency buys more dollars than before—makes foreign investments worth more when their value is translated into US dollar terms. In turn, this increases foreign investments’ return when expressed in US dollars, which is how returns are always reported to US investors.

Policy Impact Questions

Many centerpieces of President Trump’s agenda raise questions about their longer term impact on the US economy. Will higher tariffs reduce trade and raise prices? Will restricting immigration and accelerating deportation constrain the labor supply, raising labor costs and prices in general? Will talk of annexing Canada, acquiring Greenland, or backing away from longstanding commitments to defend Western Europe tend to isolate the US economically and politically? Will the administration’s ideological battle with higher education, including the withholding of federal research funding, cause the world’s top students and researchers to look beyond the US? And if so, how would that affect US leadership in the technology and health care advances that have powered so much of US wealth gains in recent decades? Time will tell the answers to these questions, but perhaps not quickly.

President Trump has displayed a certain pragmatism, regularly backtracking when policy announcements elicit strong negative reactions from the business community or markets. Examples include the quick reversal on tariffs after the stock market plunged; an acknowledgment that the administration’s deportation policy is depriving American businesses of essential workers; less talk about firing Fed chair Jay Powell; the late June US re-embrace of the NATO alliance; even a teased deal with Harvard.

On the one hand, the good absolute performance of US financial markets in 2025 suggests that investors believe these policy questions will be resolved favorably. On the other hand, both foreign stock market outperformance and dollar weakness might reflect lessened confidence in the US as a home for investment capital. The administration’s policies—and the volatility of those policies—may be giving global investors pause.

Meanwhile, though seemingly not yet on the markets’ radar, big questions lurk on topics as diverse as the national debt and the impact of artificial intelligence. Annual interest on the debt is now the single largest US budget item, exceeding even the defense budget. The OBBBA legislation passed in early July is forecast to add another $3.4 trillion to the debt over the next decade. Meanwhile, no one is quite sure whether AI will cause mass unemployment, universal wealth, and/or existential threats to humanity.

For a fuller discussion, be sure to see our Q2 Economic & Market Review.