Happy New Year! We hope this note finds you easing into 2026. For those of us who remember the turn of the millennium, it is hard to believe we have now entered the second quarter of the century.

US Stocks Do It Again

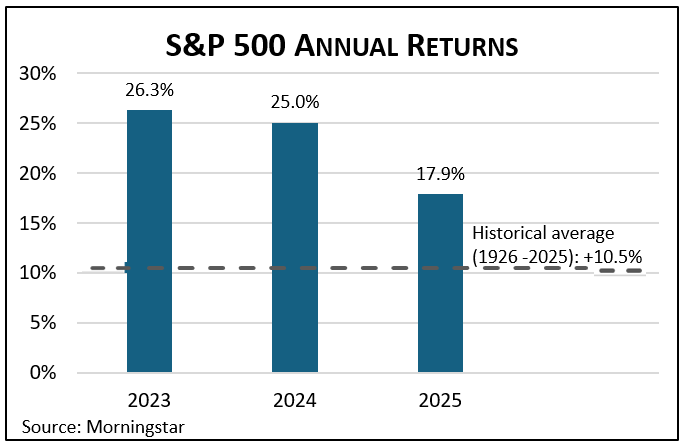

2025 was another banner year for US stocks, with the benchmark S&P 500 up 17.9%—this on the heels of returns of 26.3% and 25.0% in 2023 and 2024. The compound average return for this 3-year stretch is 23.0%, a rate at which money doubles about every 40 months! Over the past century, US large cap stocks have averaged a compound annual return of 10.5%, still terrific, but well below recent experience.

A year ago, we cautioned against expecting these eye-popping returns to continue, though we also noted there was precedent (1997-1999) for the party to continue another year. We will say it again as we enter 2026. Either we are in an unprecedented “new era” of much higher returns (as some AI futurists would suggest) or recent returns are not sustainable. Prior market booms triggered by technological advances—think railroads, electrification, autos, radio, personal computers, biotech, internet—all eventually came back to earth.

We cannot know if this is a new era or just the latest mania, but even as we suspect it’s the latter, we also don’t know when it will end. Faced with this uncertainty, we generally favor regular portfolio rebalancing, selling some of the assets that have risen the most and buying those that have gained the least. And, of course, diversification. These disciplines help keep the market boom from inadvertently pushing clients into portfolios having more risk than intended. But even here, the risk-reduction benefits of rebalancing must be weighed against the often significant tax costs of selling highly appreciated assets.

Foreign Stocks Shine, Gold Glitters

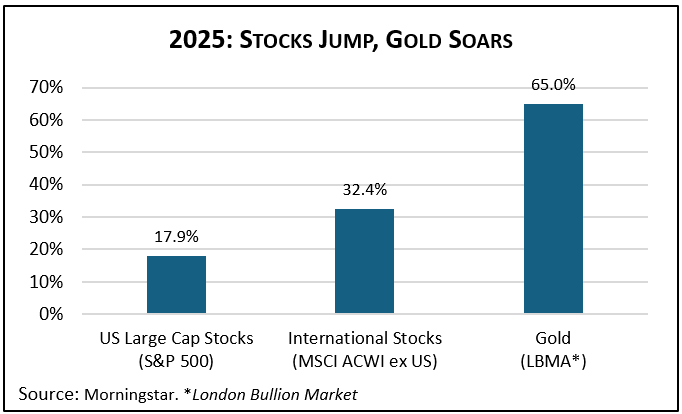

After generally lagging US stocks for many years, foreign stock markets substantially outpaced the US last year, returning about 32% overall and finally rewarding investors for international diversification. More than half the foreign markets’ return edge is explained by a roughly 10% decline in the US dollar, including a 13.3% jump in the euro. To understand this tailwind, consider a laggard German stock that went nowhere in 2025 and started the year worth $1,000. It ended the year worth $1,133, just from the currency effect.

Meanwhile, gold climbed an astounding 65% in 2025, finally surpassing its 1980 all-time high in inflation-adjusted terms. That one ounce coin in your safe deposit box is now worth about $4,500. We think of gold as a hedge against various macro trends, including inflation and geopolitical instability, things we don’t usually associate with outsized stock returns. Yet last year, gold zoomed while stocks flourished. How are we to reconcile this? Any answer is necessarily speculative, but we’ll try a hypothesis.

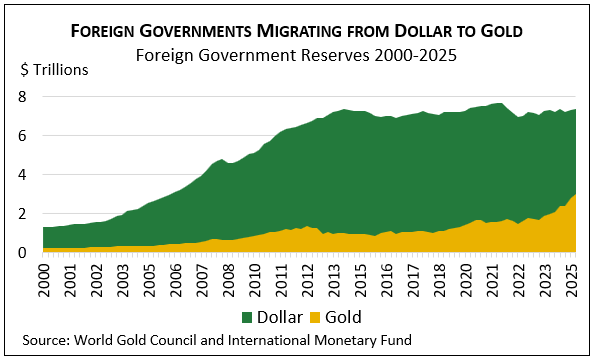

It starts with the historical dominance of the US dollar in the global financial system. For the better part of a century, the dollar has served as the world’s primary reserve currency. Combine this with the substantial policy shifts emanating from Washington since President Trump’s inauguration a year ago and you get big asset price moves. As examples, consider the US decision to impose sweeping worldwide tariffs. Or the conscious weakening of transatlantic alliances, coupled with assertions of US dominance in the Americas. Both policy changes have motivated many foreign governments to diversify their reserves away from the dollar in favor of gold, contributing to a weaker dollar, higher gold prices, and strong foreign stock markets.

Our hypothesis continues with the widely held view that the US is less focused than before on preserving the dollar’s purchasing power. This perception is fed in many ways. Examples include the worsening US fiscal picture, a vicious cycle of persistently large annual budget deficits feeding an ever-growing national debt and interest payments on that debt, in turn further ballooning the deficits. While no one knows what that magic level of US government debt is that causes markets to revolt, debt crises elsewhere have often led to high inflation. Another point of market worry is President Trump’s overt pressure on the Federal Reserve to lower interest rates—this despite inflation currently running nearly a full percentage point above the Fed’s historical 2% target.

Any loss of confidence in the US as a prudent steward of its currency’s value can be expected to drive up the price of assets with a history of preserving purchasing power. These include gold and stocks, especially stocks of companies that can raise their prices to offset inflation.

All that said, and perhaps contradicting our own hypothesis, US bonds turned in a strong year amid generally declining interest rates. The leading US bond index gained 7.3%. We will watch this tug-of-war closely.

For a detailed discussion of the economy, financial markets, and investment performance, be sure to see the Q4 Economic and Market Review.

Thank You

As we enter 2026, our 27th year, we manage more than $1 billion for more than 350 clients. We thank you for the trust you place in us daily!

We wish you and yours a healthy, happy, and safe 2026.

The Gould Asset Management Team