Global stock prices continued to gyrate wildly, and mostly downward, this week as markets adjust to a steady stream of new developments in the unfolding crisis surrounding COVID-19. Today’s more than 9% US stock market decline was its biggest one-day drop since October 1987.

Major items shaking the markets:

- Oil Price Shock—Crude oil prices fell more than 20% on Monday and are now down by half from their early January peak. Growing supply and weakening demand were already putting pressure on oil and other commodities. A breakdown in weekend negotiations among major oil exporting nations led both Saudi Arabia and Russia to announce big production boosts, launching a price war. It’s good news at the gas pump, but bad news for oil-related industries, as well as the banks and bondholders who have lent money to oil drillers and oil exporters.

- Interest Rate Shock—Investors seeking a haven sharply bid up the prices of US Treasury debt, in the process pushing the entire yield curve at one point below the 1% mark. The benchmark 10-year note yield touched 0.50%, down more than two-thirds from its recent peak (1.64%) in less than 4 weeks. Yields rebounded somewhat as the week progressed, but remain at record low levels, signaling concern about both Main Street and Wall Street.

- Demand Shock—Cancellations and postponements are everywhere. Vacations, business trips, conventions and conferences, professional and college sporting events, music festivals, college semesters…the list just keeps growing. The economic impact is hard to fathom, but it’s surely substantial.

- Liquidity Shock—As the week has progressed, we’ve seen increasing signs of strain in the credit markets, for example, even US Treasury securities becoming more difficult to buy and sell. Businesses and others have been dumping long term assets (stocks and bonds) to raise cash in anticipation of reduced cash flows from operations. In response, the Fed this morning announced it will be a large buyer of Treasury securities of all maturities. Stock and bond markets reacted positively.

All four shocks have a common source, which is the expectation of a shrinking economy in the near term. Recession risks were already somewhat elevated before the pandemic emerged. Now an economic downturn is largely unavoidable.

Stock prices have quickly adjusted to reflect the worsening outlook. In less than a month, the benchmark S&P 500 US large cap stock index has fallen 27%, putting it squarely in bear market territory and close to the average bear market’s 30% peak-to-trough decline. (Note: “bear market” simply means a market has dropped more than 20% from its recent peak. It does not imply anything about the future course of the market. Technically, a bear market lasts until the market climbs at least 20% from a recent low, at which point we are back in a bull market.)

Keeping Our Heads

So, to paraphrase Rudyard Kipling, how do we keep our heads amidst this tumult? Here’s our thoughts.

- China and South Korea have already demonstrated that with the right kind of public health response, the world can turn the corner on this contagion. We are acutely aware that the US (and others) are very different from China and South Korea, politically, culturally, and with respect to preparedness. But the question is not whether we will turn the corner, but when. As we see near sacred rituals like the NCAA basketball tournament and college graduations temporarily abandoned, we are saddened but also heartened that those in positions of responsibility are taking the situation seriously.

- A disciplined game plan, thought out well in advance of market upheaval, is the safest way to ride out a period as volatile as what we’re now experiencing. This well describes our clients’ situation.

In any market decline, there is a tendency to anchor to one’s “high water” mark, that is, the point at which your portfolio reached its historical maximum market value. For many, that point was about 4 weeks ago. It is worth remembering that almost no one intended or needed to liquidate their portfolio at that moment, nor is that the case now. In fact, a typical balanced portfolio of stocks and bonds is now about where it was in early 2019, a point at which most investors were pleased with where they were financially.

It’s more reassuring to view your portfolio over the broader time horizon for which it is intended. That applies both to its historical returns, as well as the future. Those who are in an accumulation phase will be adding to their portfolios at lower prices. Those taking distributions are taking them over a long period of time, not all at once and certainly not right now.

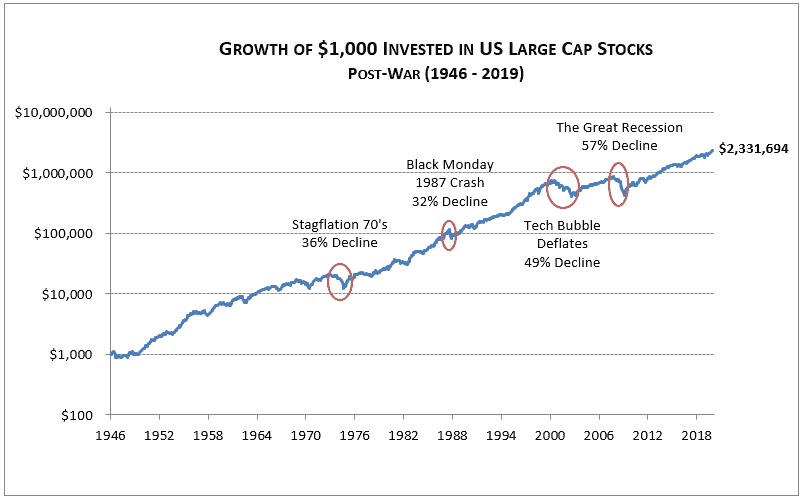

Below is a chart that shows the US stock market over the past 70+ years. We have circled several of the steepest declines, some more than 50%. Viewed from a distance, the declines can be seen to be part of the natural fluctuations of markets over time. They can also be seen within the context of the longer-term upward trend that is the product of economic growth.

We’ll be the first to tell you that we don’t know where the current decline will bottom out. It might be near current levels or it could be substantially lower. It’s almost certain that markets will remain volatile for some time to come. That said, we are firmly convinced that economic growth will resume in time. The stock market will likely see it coming before others and could easily turn upward well in advance of the economic statistics.

The COVID-19 pandemic and its associated economic and financial fallout are very serious. There’s no way to sugarcoat what we’re all experiencing. But like crises of the past—wars, depressions, terrorism, and even pandemics—it will pass in time and portfolios will recover.

We’re Here for You

However long it takes to turn the page on this disquieting chapter, we will be there with you throughout. Please don’t hesitate to pick up the phone or email if anxiety is getting the better of you. That’s why we’re here.