by Don Gould

“Give us your clunker and save on taxes!” “Call your PBS station right now and make a tax-deductible donation to support public television!” By now, it has been well pounded into our brains that donations to qualified charities are tax-deductible in the year the gift is made.

The implication is that the donation will lessen your tax bill, reducing the donation’s net cost to you. But that’s not always the case. With year-end approaching, it’s a good time for a refresher on the most tax-smart ways to make your gifts to charity.

In part one of this two-part series, I’ll focus on how to increase the tax savings from your charitable donations. Keep in mind that the real prize to tax-smart giving is that you can potentially give much more to your favorite charities at the same net cost.

To Itemize or Not

Understand that the charitable deduction only benefits taxpayers who itemize their deductions on Schedule A of the Form 1040 tax return. And it only makes sense to itemize your deductions if they total more than the “standard deduction” the IRS affords to all taxpayers.

The tax bill passed in late 2017 boosted the standard deduction for single filers from $6,500 to $12,550 and for married couples from $13,000 to $25,100. If you’re married and your itemized deductions total less than $25,100, you are better off taking the standard deduction and not itemizing.

At the same time, the 2017 tax bill severely limited the so-called SALT (state and local tax) deduction. Taxpayers in states with high income tax rates, including California, were hurt most by this change. Previously, the SALT deduction had been the single largest category of itemized deduction, followed by mortgage interest and charitable contributions.

Together, these two changes have cut the number of taxpayers who itemize by more than two-thirds. And if you don’t itemize, then your next donation to charity will not reduce your tax bill. But fear not—there are still ways to make your gifts more tax-efficient.

(Note: there is one exception to this rule. In 2021, even people who do not itemize can take a deduction for cash donations to charity—$300 for a single person, or $600 for a married couple.)

Bunching Your Donations

Suppose you are a married couple that gives $8,000 annually to charity. And let’s further assume that this plus your other potential deductions totals less than the $25,100 standard deduction. In that case, you will use the standard deduction. The $8,000 you give to charity each year will not reduce your tax bill.

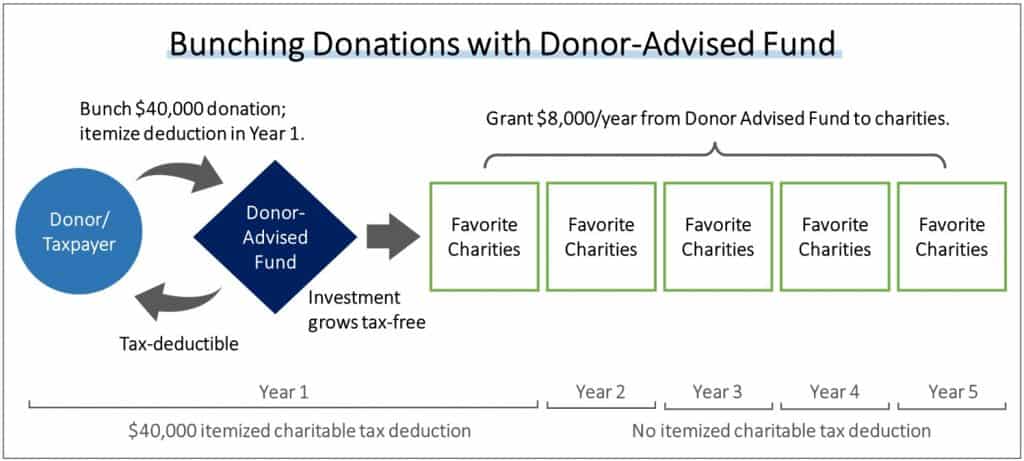

But if instead you make five years’ worth of gifts in a single year ($40,000 total), you would be able to itemize in the year of that gift and significantly reduce your taxable income. This is sometimes called “bunching” your donations.

The Donor-Advised Fund to the Rescue

I hear you thinking, “But my favorite charities need money every year, so I would like to give every year.” Fair enough, and happily there is a clever workaround. It’s called the “donor-advised fund,” or DAF.

A DAF is itself a qualified charity. Fidelity Charitable is the largest, but there are many other DAF sponsors, including Schwab and Vanguard. With a DAF, instead of making donations directly to charities, you can make a lump sum tax-deductible gift to an account you create with the DAF. You then instruct the DAF to make “grants” to your selected charities, whenever you like.

In our example above, you could bunch your donations by making a $40,000 donation to the DAF in 2021, enabling you to itemize deductions and save on this year’s tax bill. Then you can grant $8,000 per year from the DAF over a 5-year period, accomplishing both your tax and charitable objectives. See the accompanying chart for an illustration.

Note: Only your gift to the DAF is tax-deductible. The subsequent grants from the DAF are not. Even if the charity receiving the DAF grant sends you a nice receipt, do not try to take the same tax deduction twice!

Coming in Part Two

In part two next week, I will discuss why donating appreciated securities is better than donating cash. That holds true whether you make donations directly to a charity or via a DAF. I will also talk about the remarkable opportunities that IRAs and other retirement plans offer for making tax-efficient donations to charity.

[This article provides general guidance. As with all tax matters, you should consult with your tax advisor before making tax-related decisions.]

Don Gould is president and chief investment officer of Gould Asset Management.