Mama Said There’d Be Years Like This

To paraphrase the old song, mama said there’d be years like this. Notwithstanding such warnings, 2022 has been a jarring time for investors.

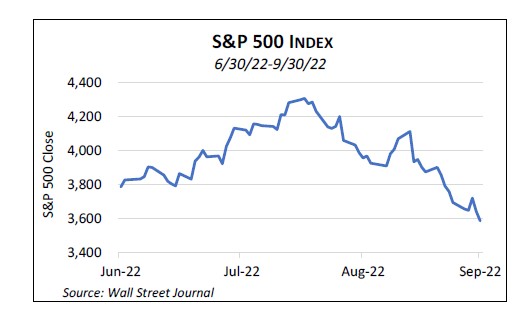

It’s a bit of a cliché to say that the stock market took a roller coaster ride, but the third quarter’s chart looks right out of an amusement park. The market chugged mostly upwards from the start of the quarter into mid-August and then abruptly plunged, with the S&P 500 index ending about 5% below where it began the quarter.

Stubbornly high monthly inflation reports made clear that central banks would continue pushing interest rates higher in a bid to dampen price pressures. Interest rates across the yield curve spiked in August and September, directly pushing down bond prices and indirectly pummeling the stock market. Higher interest rates shrink corporate earnings and reduce what stock investors will pay for the earnings that remain, a double whammy.

Nowhere to Hide

In most economic environments, the same factors that cause stocks to fall—economic slowing—also push up the price of high quality bonds. And bonds usually are much less volatile than stocks. Together, these characteristics cushion against stock market declines in portfolios having some balance of stock and bonds. A notable exception is when central banks are fighting inflation with higher interest rates, causing stocks and bonds to fall in tandem. 2022 is just such a year and that’s what has made it so challenging. Year-to-date through the end of the third quarter, the S&P 500 stock index and the Bloomberg Aggregate Bond index are down 24% and 15%, respectively, leaving investors with almost no place to hide. To get some perspective on how unusual 2022 has been, bonds are having their worst performance in 70 years.

Diversification across asset classes usually reduces portfolio risk, but as we’ve seen with stocks and bonds moving in tandem this year, it’s no guarantee. On rare occasions, several baskets of eggs get dropped at once. We note, for example, that some portfolio investments fell at the very end of the quarter due to insurance losses caused by Hurricane Ian. Natural disasters are almost completely uncorrelated with general economic trends, yet this hurricane managed to land itself just inside an already bad quarter for financial markets. Likewise, in the third quarter the UK selected a new prime minister, Liz Truss, after the unscheduled departure of PM Boris Johnson. Truss quickly announced simulative tax cuts in the face of double-digit inflation, sparking an immediate crisis in UK bond and currency markets that rippled around the globe. Meanwhile, the war in Ukraine continues to inflict significant economic damage in western Europe and beyond. When it rains, sometimes it pours.

Silver Linings

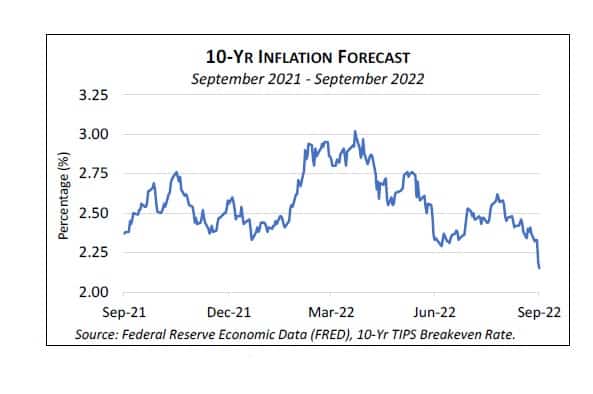

Inflation has been the single largest driver of stock and bond market weakness this year. And while the monthly CPI reports continue to show high levels of inflation over trailing 12-month periods, bond markets now forecast inflation averaging less than 2.5% per year over the next two years. Certainly, bond market forecasts are not infallible—bond investors were mostly caught off guard by the current inflation spike. But the real (inflation-adjusted) returns on investments of literally trillions of dollars are riding on these forecasts, so we take them seriously. Hard as it may be to envision right now, lower inflation may be in the offing.

Another silver lining is today’s higher bond yields. While the recent rise in yields depressed the price of existing bonds, on the flip side, investors will now invest and reinvest (for example, bond interest and principal received at maturity) at much more attractive rates. For most of the past 40 years, declining interest rates juiced current bond returns while shrinking future expected returns. Now we see that process work in reverse.

For a fuller discussion, be sure to see our Q3 Economic & Market Review.