We hope your summer is off to a good start.

US Stocks Bounce Back

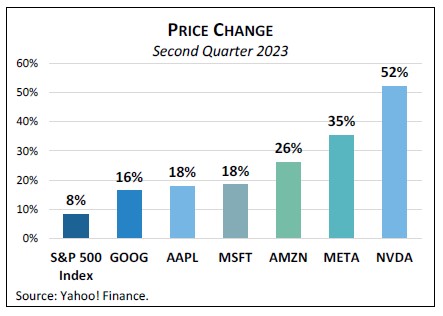

US stock indexes zoomed in the second quarter, with the S&P 500 large cap price index up 8.3%. By early June, the index entered bull market territory, having climbed 20% from its October 2022 low. Stocks were powered higher by a small number of the largest companies, most notably Apple, Microsoft, Nvidia, Amazon, Meta (Facebook), and Alphabet (Google)—call them the Big 6. On June 30, Apple became the first company to surpass a $3 trillion market capitalization (the total value of the company stock).1 Microsoft is not far behind at $2.5 trillion.

Only five years ago, we marveled at Apple hitting the $1 trillion mark and wondered how any single company could be so valuable. Together, Apple and Microsoft account for nearly 15% of the total value of the S&P 500. Most of the Big 6, especially Nvidia, rode a wave of enthusiasm on rapid advances in the artificial intelligence (AI) world. Nvidia makes chips that support AI processing; its stock vaulted 189% in just the first six months of 2023, bringing its market capitalization to over $1 trillion.

The accompanying chart shows the price change of the index compared to the change for each of the Big 6. As these mega-cap stocks dramatically outpaced the index return, it will come as no surprise that the rest of the S&P 500 substantially underperformed the index itself. Therein lies a lesson we repeat often. Most of the performance in any broad index is concentrated in the performance of a small handful of stocks. We never know in advance which stocks those will be, which is why owning the whole index is the only way to make sure you have exposure to the few super-stocks that drive the index’s return.

Systemic Risks Recede

We entered the quarter facing two potential financial emergencies. First was the crisis among larger regional banks, triggered by bank runs and ultimately the failures of Silicon Valley Bank and First Republic Bank. Fortunately, worries in this sector have subsided, although one underlying problem remains—a poorly designed federal deposit insurance program. A similar crisis could await us somewhere down the road.

The second concern related to the need to raise the US national debt ceiling. Absent legislation, by sometime in June the federal government would not have been able to borrow, resulting in an inability to pay all its bills. We were pleased to see Washington reach agreement in late May, a bullet dodged at least a few days before financial markets might have wobbled. On cue, the US stock market surged through the end of the quarter.

A Confounding Economy

The US economy is a study in contradictions. Despite the highest short-term interest rates since 2006, the economy continues to grow at a good clip, keeping the labor market tight and inflation elevated. The Fed raised its federal funds rate in May (to a 5.00%-5.25% range) and then took a pause in June. But while inflation is down more than half from its 9.1% peak reached a year ago, at 3%-4% it remains above the Fed’s 2% long-term target, so most expect the Fed to raise rates at least once more in coming months.

By a common measure, the US Treasury yield curve has been inverted for a full year (short-term interest rates above long-term). This often portends recession, but none is yet in sight. To be sure, sectors sensitive to interest rates, like real estate, are feeling the bite of the Fed’s rate hikes. So far, however, the impact has not been sufficiently widespread to push the overall economy into recession.

Surprisingly persistent economic strength pushed bond yields higher last quarter, causing a small decline in bond prices. Still, bonds are modestly ahead year-to-date, performance vastly better than last year’s bond market debacle. The strong June jobs reports pushed yields higher still in early July, though they also hinted at some deceleration in growth, news the Fed would welcome.

For a fuller discussion, be sure to see our Q2 Economic & Market Review.