Stocks Continue Their Ascent, Whatever the Reason

Following a strong 2023, stock market gains accelerated in the first quarter, with the leading global benchmark up 8.3% and the US large cap S&P 500 surging 10.6%, or roughly what the market averages in a full year.

Investor psychology can be a major driver of short-term market performance. One clue is to watch how the media rationalizes each market move. When psychology is bullish, any piece of news has a silver lining. Conversely, when investors are in a dour mood, both sides of the coin are “tails.”

The first quarter was a case in point for the bull camp. Much of 2023’s gains were predicated on the expectation that the Federal Reserve would cut short-term interest rates as economic growth moderated. (Lower rates make stocks more attractive in relation to bonds.) Instead, the economy defied almost universal predictions of recession, and in 2024 it is powering ahead on the back of jobs gains that continually surprise on the upside. Of course, this postpones any Fed rate cuts, which by 2023’s standards should be bad news for markets.

Yet stock markets continued their climb in the first quarter, necessitating a change in the pundits’ explanations. Conventional wisdom now is that higher employment and the artificial intelligence (AI) boom should push stocks higher. This is a reasonable hypothesis, though it conveniently ignores 2023’s focus on interest rate cuts as the key driver of equity market performance.

For an investing public that understandably wants to know the “whys” of market moves, the influence of mass psychology can be a bit discomfiting. While rationality eventually prevails in markets, one investment industry veteran has likened the process to the effect of gravity on a feather in a windstorm. A loose feather will eventually reach the ground, but the path will be circuitous and cannot be predicted or explained.

AI – The Latest Mania

Every so often there comes along a scientific or technological breakthrough that bowls us over with its world-changing potential. The birth of the internet in the 1990s was one such instance. Arguably, the advent of widely available artificial intelligence (AI) engines over the past 1-2 years is another. With each big new thing there is usually a publicly traded company that, through luck or foresight, finds itself positioned to reap extraordinary profits from the sudden burst of demand for its product, and finds itself the darling of investors.

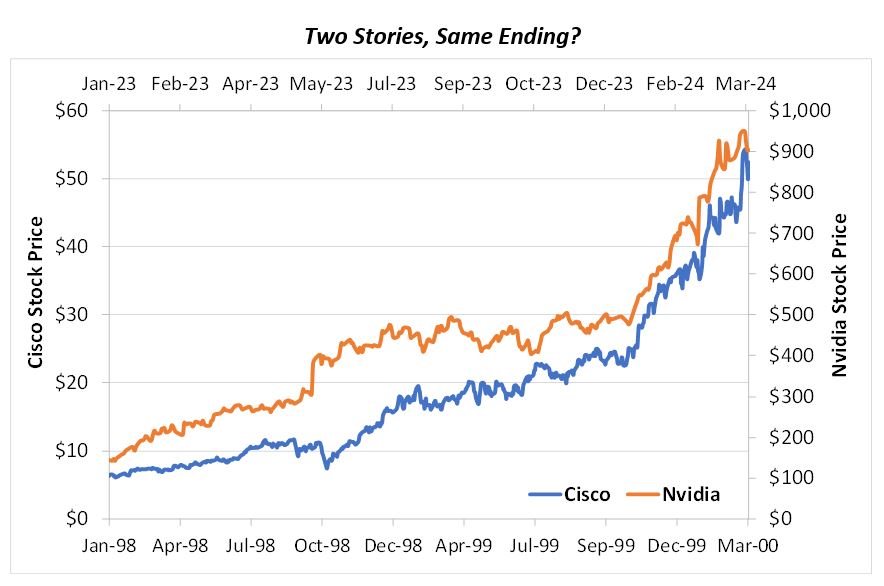

In the internet boom, that company was Cisco Systems. Cisco was the leading manufacturer of routers, an essential hardware component for virtually every internet-ready business and household. With AI, that company is Nvidia, a chipmaker whose product is particularly well suited for the massive processing demands of AI.

From the beginning of 1998 to about the end of the first quarter of 2000, Cisco stock rose 761%. Over a shorter period, from the beginning of 2023 to late March this year, Nvidia climbed 550%. Nvidia now sports a market capitalization of over $2 trillion, trailing only Microsoft and Apple.

Cisco stock peaked in March 2000 at about $80/share, bottomed out a year later at under $14/share, and then languished for a decade. 24 years later, the stock still rests 10% below its 2000 peak.

Investors correctly marked the internet as an epochal change. Where they erred with Cisco was projecting that trend onto the fortunes of a single company. Giant profits always attract competition, driving down prices and profits. As we watch the understandable hype surrounding AI, it’s important not to get carried away with projections of perpetually growing AI riches for a select few companies.[1] We are not forecasting Nvidia’s future—remember that feather in the windstorm. But diversification remains the sensible course here, enabling investors to participate in the big winners of both today and tomorrow.

[1] Bloomberg columnist John Authers has highlighted the parallels between Cisco and Nvidia.

For a fuller discussion, be sure to see our Q1 Economic & Market Review.