A Robust and Bumpy Rebound

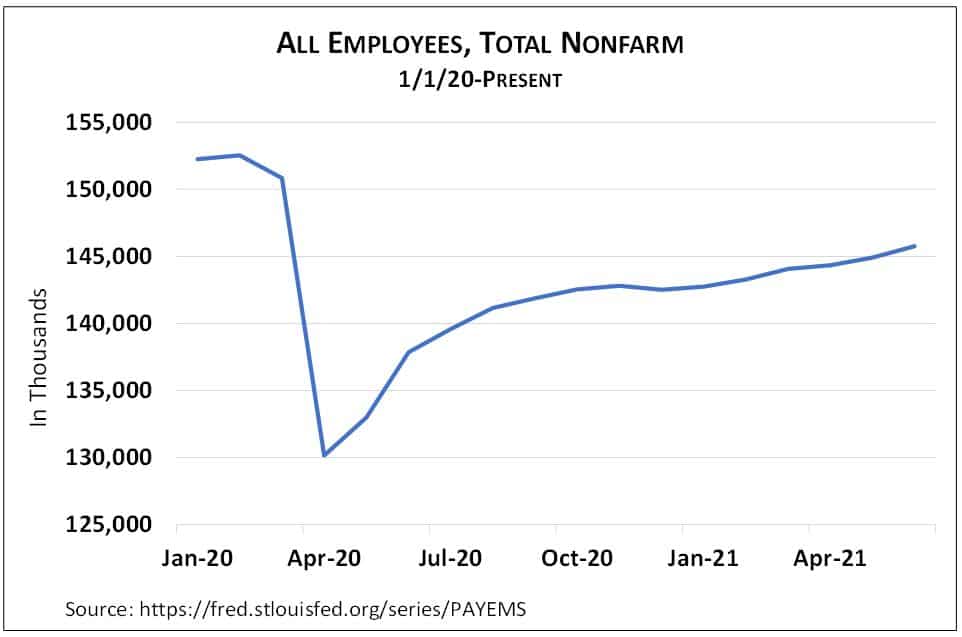

The US economy continued its sharp rebound last quarter as the pandemic receded. June payrolls alone showed a nearly one million gain in the number employed, meaning the economy has recovered about three-fourths of the jobs lost in the depths of the spring 2020 lockdowns. At a glance, a visit to an airport or restaurant looks in many ways like 2019, with some obvious differences. On the other hand, in many places it’s hard to get to the airport—Uber/Lyft rides are suddenly scarce and pricey. That’s just one sign that the post-pandemic economy will be quite different from the pre-pandemic one, and the road connecting the two will be bumpy.

A meaningful portion of those who left the workforce in 2020 are choosing not to return to their previous jobs. The now ubiquitous “Help Wanted” sign shows that many former leisure and hospitality workers are seeking new careers offering better pay and employment stability. We also see baby boomers accelerating their retirement plans. Adding to the adjustment challenges, the near overnight adoption of telework has upended assumptions about the connection between work and residence.

On the path to a new equilibrium, the economy is experiencing shortages of both goods and services, one consequence being rising prices in many areas. Albeit temporary, long-lasting disruptions in supply chains—for example, chip shortages—have pushed up the prices of all variety of consumer goods, as well as the wait times to get them. Home prices are way up, especially in the suburbs, as many of the children of boomers seek more space and a telework-friendly setting. Prices on new and used cars, as well as rental cars, have soared in the face of inadequate supply, the result of both production slowdowns during the pandemic and parts shortages after.

The Market Also Rises

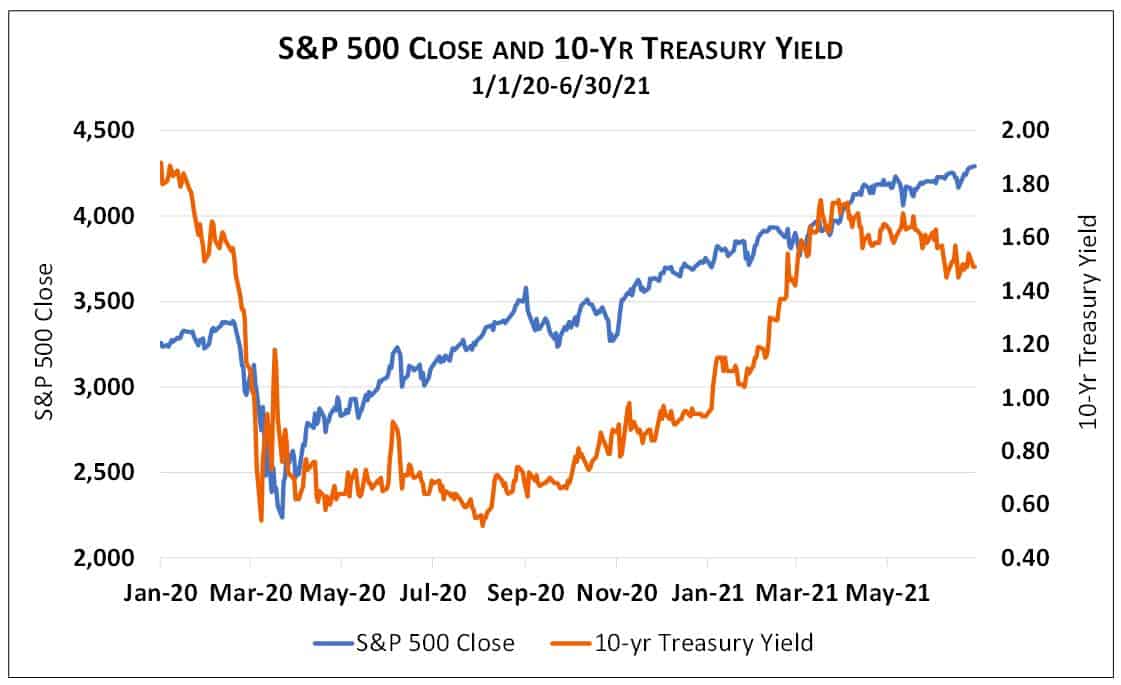

Meanwhile, the stock market is well into its second year of a boom following its sharp decline at the outset of the pandemic. The S&P 500 turned in yet another strong quarter, returning 8.55% and bringing its return for the first half of 2021 to just over 15%, a remarkable showing after climbing more than 18% in a highly volatile 2020.

We keep saying it—and like a stopped clock, we will eventually be right—this rate of stock market ascent is not sustainable. Over the past century, the US market has averaged about a 10% per year return, and that was achieved in a period of faster economic growth than we’ve generally seen since the turn of the 21st century. The price-to-earnings (P/E) ratio—essentially, the price an investor pays for a dollar of corporate earnings—is at lofty levels seen only about 2% of the time historically.

We will hasten to add that this does not mean a decline is imminent. With real (inflation-adjusted) interest rates at historic lows (in fact, below zero[1]), it makes a high P/E ratio more understandable. Today, cash pays zero interest and bonds only modestly more, so fixed income is not giving equities a lot of competition. A $65 steak may seem reasonably priced when the alternative is a $35 omelet. Despite a rapidly recovering economy and an inflation spike, bond yields show no sign of moving up. To the contrary, the yield on the benchmark 10-year US Treasury fell in the second quarter from 1.74% to 1.45%, and that decline has accelerated in early July.

Still, things can change quickly in financial markets. We continually

remind clients to maintain realistic expectations and not get carried away

during the buoyant times or too pessimistic during the inevitable downturns.

[1] For more on the implications of negative real interest rates, see these two recent blog posts: https://gouldasset.com/2021/05/money-and-inveting-the-one-economic-number-to-watch-part-1/ and https://gouldasset.com/2021/05/money-and-inveting-the-one-economic-number-to-watch-part-2/.