by Don Gould

Savers rejoice! Short-term interest rates, such as those on U.S. Treasury bills, recently breached the 5% level after sitting near zero for nine of the past 14 years. Cash is no longer trash; “financial repression” — that is, central banks keeping rates at rock bottom to stimulate the economy — is taking a welcome breather. As important, today’s cash interest rates are above the inflation rate, meaning that the purchasing power of cash is growing, in contrast to the zero-rate years when cash lost roughly 2% of its real value annually.

Of course, elevated interest rates are bad news for borrowers, but that’s precisely why the Federal Reserve has jacked up rates over the last year and-a-half. Higher rates slow the economy, helping fight post-pandemic inflation.

Getting your fair share

How much you benefit from today’s more generous rates depends on where you keep your cash. Some diligence is required. For example, you might think your checking or savings deposit at, say, Bank of America, Chase, or Wells Fargo is paying you interest commensurate with today’s higher market rates. Not so! Their rates remain mired at pandemic-era lows, ranging from 0.01% to 0.25%. A depositor with a $50,000 balance at these large banks is leaving about $200 per month on the table. Their CD rates are higher, but still uncompetitive.

A simple solution for getting your fair share is a U.S. Treasury money market fund, an indirect way of owning short-term Treasury bills that offers the same daily access to your money as a bank account. Fidelity and Vanguard are two of the largest money fund providers. Adding to the appeal of Treasury money funds, income from some of these funds is mostly exempt from state income tax, an important consideration for Californians.

Another option is an online savings account such as Ally and Synchrony Banks. Keep in mind, however, that online bank accounts do not provide the same state tax benefits as treasury money funds and usually carry somewhat lower yields.

Don’t go overboard

In Greek mythology, the sirens were creatures whose sweet voices lured sailors to destruction. Today they sing to investors, “Five percent return, government guaranteed!” It sounds enticing, especially after the stock and bond market volatility we’ve experienced over the past three to four years. Some pundits go so far as to recommend big portfolio reallocations in favor of cash. Not so fast, I say.

Remember, the 5% that’s advertised today is only promised for the short duration of the T-bill (or CD). The rate available to you when the T-bill matures in a few months is unknown and could easily be much lower than today’s rate. In fact, markets are predicting just such an outcome.

By all means, make sure your cash is getting the best rate possible. But that’s different from moving funds from longer-term investments, such as stocks and bonds, to cash. Historically, such market timing has been an extraordinarily costly practice.

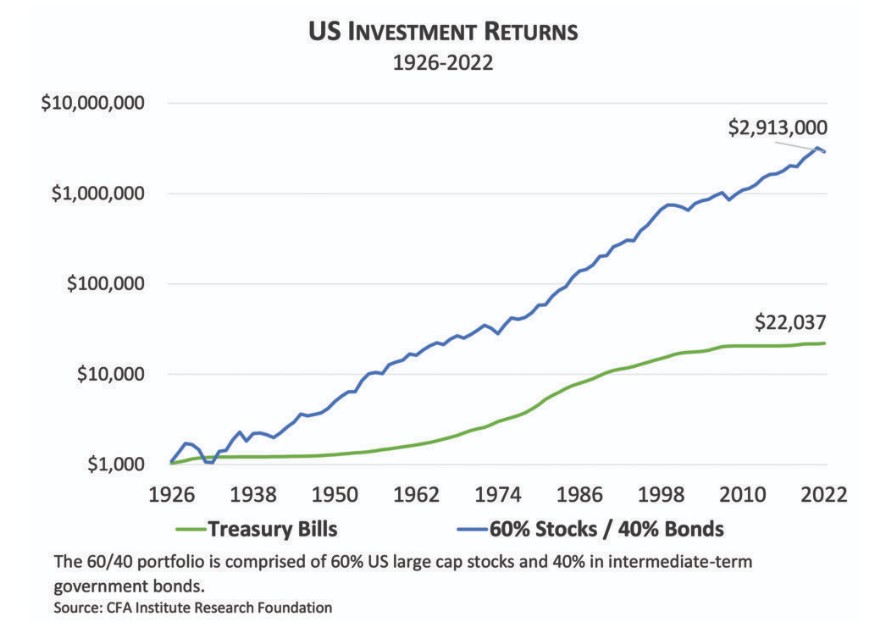

Long-term investors have been handsomely rewarded for taking on the increased volatility of stocks and bonds. The extra return as compared to cash is astounding. To illustrate, $1,000 invested in 1926 in a constant 60% stocks, 40% bonds portfolio grew to more than $2,900,000 by the end of 2022. The same $1,000 invested in T-bills grew to only about $22,000, barely keeping ahead of inflation. The balanced stock/bond portfolio beat cash by a factor of 132! Such is the magic of long-term compounding.

In theory, one could have done even better (with a perfect crystal ball) by jumping to cash just before each market downturn and switching back to stocks and bonds right after they’ve bottomed out. Perhaps not surprisingly, no one in the history of investing has been able to do this consistently. What are the odds that that you or your advisor will be the first?

In fact, studies of retail investor behavior suggest that many people do just the opposite, plunging into the stock market after big runups and selling out after fearful declines. Frequent switching also can result in substantial tax liability.

Today’s higher short-term interest rates are indeed a refreshing change for savers, but don’t let their siren song lure you into altering well considered long-term investment strategies.

Don Gould is president and chief investment officer of Gould Asset Management of Claremont.