by Donald Gould

This is the third in a three-part series of reflections on changes in the investment industry in the 25 years since I started Gould Asset Management in Claremont.

Perhaps the most important trait an investor can have is humility, a lesson I’ve been taught repeatedly over the past quarter century. The good news is that if you don’t have humility yet, markets will eventually provide it to you free of charge, except for the hole in your month-end brokerage statement. With humility comes respect for markets, even when you disagree with their verdict.

The Wisdom (and Madness) of Crowds

In his excellent book, The Wisdom of Crowds, James Surowiecki demonstrates that a large group of non-experts, on average, arrives at more accurate estimates than even the most informed expert. Market prices represent the weighted average opinion of a very large crowd at any moment in time, so market “experts” who ignore prices do so at their peril.

Of course, crowds can also be spectacularly wrong. Another investment classic, Charles Mackay’s Extraordinary Popular Delusions and the Madness of Crowds, documents how mass psychology can drive up prices to ridiculous extremes. A famous example is the Dutch tulip mania of 1634-1637. At its height, a single bulb cost more than ten times the annual earnings of a skilled artisan.1

I’ve been thinking about the market crowd even more than usual of late. In the 100+ days since the inauguration, the new administration in Washington has shattered more norms more rapidly than almost anyone might have imagined. However one feels about this, these actions raise important questions for investors. Here are a few of mine.

Some Questions for the Markets…

Immigration. President Trump has pledged to deport more than ten million unauthorized immigrants. Will his plan succeed and, if so, will the workforce shrink, or will citizens fill the gap? And if there are fewer workers, how will that affect labor costs and the inflation rate?

Trade. The president in early April imposed higher tariff rates on scores of countries, notably a 145% rate on imports from China and a 25% rate for Canada and Mexico. A month later, most of the tariffs are on hold, and the China tariff has been temporarily scaled back to 30%, though tariffs remain well above their pre-April levels. Tariffs act as a tax on consumers and businesses, reducing economic activity and raising prices at the same time. Will tariffs, as the president asserts, lead to a resurgence in US manufacturing and raise revenue that will permit tax cuts? Or will tariffs push the US and the world into recession? Or both? And how soon?

Foreign Relations. The past three months have seen some cooling of US relations with traditional allies here in North America and across the Atlantic. Administration actions have raised questions about the longstanding US commitment to defend western Europe against potential Russian aggression. Meanwhile, the president’s oft-stated desire to annex Canada and acquire Greenland have caused tensions closer to home. How might these actions affect economic activity between the US, its neighbors, and western Europe? Will new economic and political alliances emerge as a result? Will a less interconnected America be a more prosperous America?

Higher Education. The new administration has launched an ideological battle with many prominent American universities. Harvard is the most notable example, where the government has frozen billions of dollars of federal research funding and threatened other actions unless the school yields to a series of administration demands. Will cutbacks in university research be permanent? If so, how will this affect discovery and innovation in health care, technology, and other areas? Will this change where top researchers choose to work? And how might this affect the technology entrepreneurship that has powered so much of America’s wealth gains in recent decades?

Larger questions, beyond our scope here, would examine the relationships between financial markets, capitalism, democracy, and the rule of law.

…And Some Tentative Answers

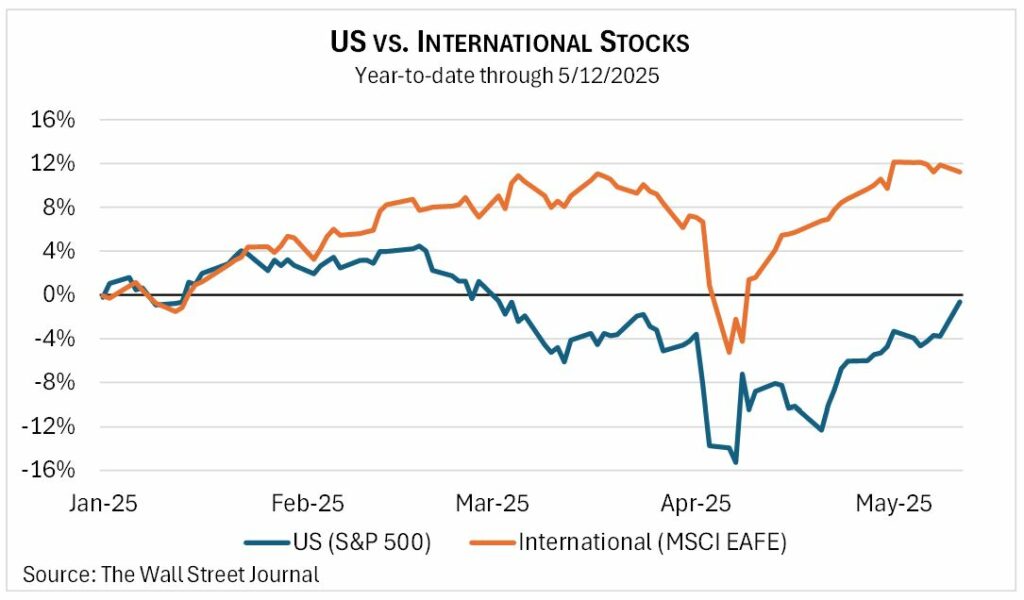

Returning now to the wisdom of the crowd, let’s see how markets might be answering some of these questions. Through May 12, the leading US stock index (the S&P 500) is down about 1% in 2025, though it is up substantially from its initial plunge after tariffs were announced in early April. In contrast, the leading international stock index (MSCI EAFE) is up about 11%, a full 12 percentage points above the US. Fueling the gap is this year’s 6% decline in the US dollar against a basket of foreign currencies. The recent strong relative performance of foreign stocks and currencies runs counter to the most recent 15-year period, during which US stocks and the dollar generally outperformed the rest of the globe.

Explaining market performance is inherently speculative, as we’re trying to read the mind of the crowd, but here goes. In the stock market’s late April recovery, investors might be saying that tariffs will be permanently rolled back to a level that won’t be as damaging as first feared. Meanwhile, strong relative performance of foreign stocks, coupled with dollar weakness, might reflect the view that administration policies more generally will cause US economic interests to suffer.

That’s some of what markets might be telling us today. Tomorrow may be a different story. And even if we could foresee future events, we still would not know with any certainty how markets would respond. So, keep listening to the market’s messages. To paraphrase those clever beer ads, stay humble, my friends—especially when you find the market’s messages most confounding.

Donald Gould is president and chief investment officer of Gould Asset Management of Claremont.