by Don Gould

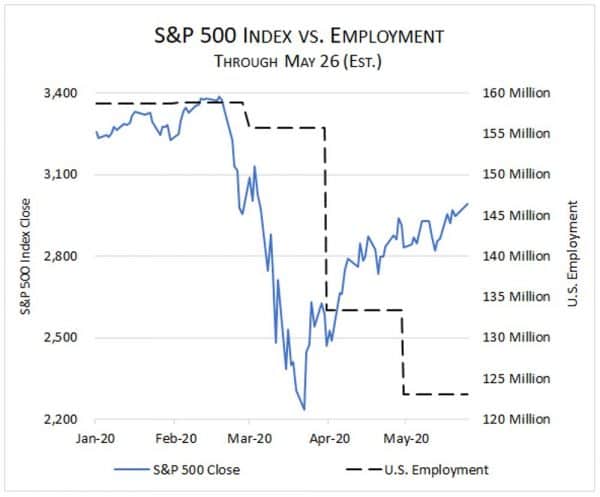

It is often said that the economy is not the stock market, and vice versa. Never has that seemed truer. In the economy we have witnessed an unimaginable explosion in unemployment, the byproduct of lockdowns to slow the Covid pandemic. 39 million Americans have filed unemployment claims in the last nine weeks alone. GDP numbers will soon show the largest contraction since the Great Depression.

Meanwhile, the stock market seems relatively—and surprisingly—unfazed. After a precipitous month-long decline beginning in mid-February in which the S&P 500 index dropped 34%, the benchmark has marched steadily upward over the past two months, recouping about two-thirds of its decline. What can explain this seeming “disconnect” between the economy and the market?

Suggestions that the economy and the market exist in two parallel and unrelated universes are nonsense. Stock prices represent the present value of a future stream of corporate earnings. In turn, earnings depend on economic activity.

Four factors may explain the robust performance of the US stock market in recent weeks.

Bigger Winners, Smaller Losers – A disproportionate share of lost revenue has been in lower profit margin industries such as restaurants, lodging, and airlines. Consequently, the stocks hardest hit have been those with lower market capitalizations (the aggregate dollar value of all the company’s outstanding shares). Think of Apple as a huge and highly profitable company that has emerged (so far) relatively unscathed. Contrast that with the much smaller United Airlines, a stock that is down about 70%. Just five technology companies (Microsoft, Apple, Amazon, Alphabet (Google), and Facebook) account for more than 20% of the total value of all stocks in the S&P 500. Their comparatively strong recent performance explains much of the stock market’s resilience.

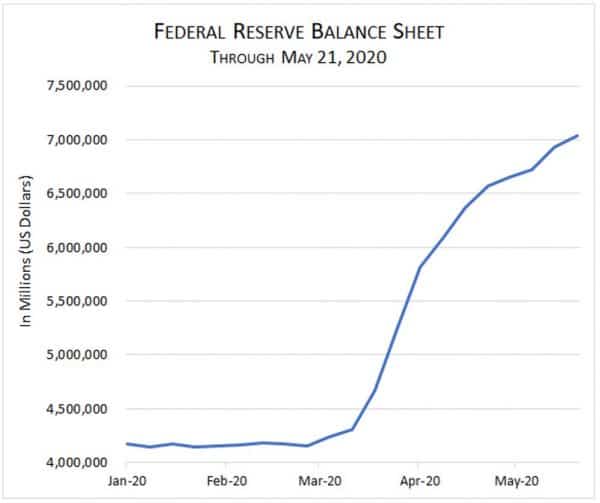

Federal Intervention – Since March, the Federal Reserve has purchased a staggering $3 trillion in bonds to support credit markets, keep interest rates low, and generally try to keep the financial system functioning. Though not the Fed’s stated intent, much of this money indirectly finds its way into other categories of assets, including stocks. Some of the $3 trillion CARES Act stimulus—the portion not immediately spent by recipients—also ends up in financial markets, supporting stock prices.

Lower Interest Rates – Interest rates across the maturity spectrum have plunged since February. In just three months, the benchmark 10-year US Treasury yield fell by more than half, from about 1.7% to 0.7%. 3-month Treasury bills have dropped even more, from about 1.6% to 0.1%. Other things being equal, lower interest rates push stock prices higher by making bonds and cash relatively less attractive.

Looking Beyond the Crisis – As noted earlier, the price of a stock represents the value of a stream of future cash flows stretching far into the future. If today’s economic disaster is expected to recede in a few months or a few quarters, after which the economy snaps back to something resembling its pre-Covid state, it can be argued that the current awful state of many businesses becomes less relevant in determining their long-term value.

Cautionary Thoughts

Before getting too giddy about the stock market’s prospects, it is worth remembering the many uncertainties that still lie ahead. Signs of reopening are everywhere, even in the more cautious states like California. Will this lead to another spike in Covid cases in the remainder of 2020? Many businesses that employed the newly unemployed may never return. How quickly will the economy be able to absorb these workers? Will the federal government assist fiscally strapped state and local governments? How will election year politics affect things? When will we have effective therapies and/or vaccines?

The economy and the stock market cannot diverge indefinitely. No company is immune from a huge and protracted reduction in consumer purchasing power. The stock market’s recent performance should therefore be taken as an optimistic view on the speed and strength of economic recovery. Here’s hoping!

Don Gould is president and chief investment officer of Gould Asset Management.