Massive Market Rebound…and Head Scratching

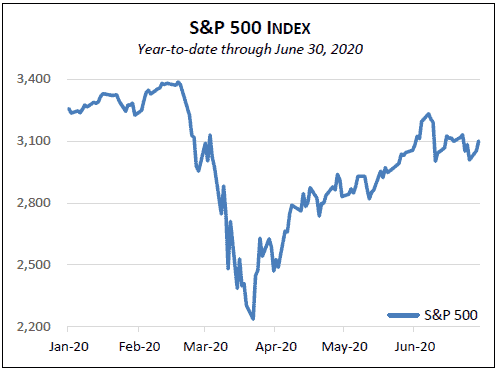

The second quarter saw a rebound for the record books. After a harrowing 34% decline beginning in mid-February and ending in late March, the S&P 500 US large cap index rocketed nearly 39% through the end of June, its best 100-day gain in 80 years.

The market recovery has just about everyone scratching their heads, considering the backdrop of the Covid pandemic, the ensuing severe economic downturn, nationwide racial justice protests, and a volatile election season. As this is written in mid-July, US stocks are at the same level as they were in mid-December, when tens of millions of now unemployed still had jobs. Markets have a way of confounding, but never have we seen such remarkable dissonance between the market and the economy. At this point little would surprise us, including a market that could surpass both the February all-time highs and the March lows before the year is out.

Explanations abound, and we provided some hypotheses in a recent client letter that can be found on our website here [1]. We will admit that markets feel frothy. To take just one example, electric car maker Tesla dropped by 60% in the first quarter swoon and has since quadrupled, giving the company a market capitalization exceeding a quarter trillion dollars. Founder Elon Musk is surely a genius and owners love the cars, but keep in mind that this is a company with virtually no earnings and a less than one-half of 1% share of auto market sales.

Keeping Our Heads Amid Fear and Greed

The key in these circumstances is not to get carried away by the apparent momentum of stock prices, in either direction. One reason we regularly rebalance client portfolios is to make sure that the market’s emotional swings don’t carry us too far in either direction from the client’s intended risk/return profile. Rebalancing provides a discipline independent of our own emotions or opinions of whether the market is “crazy.”

We also note that an “expensive” market can get much more so before reversing course. Many observers thought the dot-com boom of the late 1990s was getting out of hand by mid-1997. Though they might have been right, the market still proceeded to climb another 70% before peaking nearly three years later. The subsequent 80% decline in the tech-heavy Nasdaq index vindicated the naysayers’ views, but the three years it took to get there were excruciating to say the least.

Where Now

The economy has much to overcome before things return to some semblance of normalcy. First and most obviously, there is the uncertain course of the pandemic. The bungled spring reopening in many parts of the country resulted in a sharply rising case curve again, causing both officials and consumers to pull back just as signs of recovery were taking hold. The initial massive dose of government stimulus is waning, and the timing and substance of another economic aid bill is uncertain.

There is more pain ahead. To take just one example, consider higher education. In the past few weeks, colleges and universities nationwide have announced a mostly or completely online course offering for the fall. Empty dorms and dining halls and likely shrinking enrollment will cause massive budget shortfalls. The result will be furloughs or layoffs and further battered college town economies, not to mention a major dislocation in the lives of students and their families.

There are many ways out of this conundrum—better/quicker/cheaper testing; improved therapies; effective and broadly available vaccines; enlightened public policy and leadership; rational and considerate behavior among the citizenry—any combination would speed recovery. Signs of progress are visible on some of these fronts, but a great deal remains to be done.