by Don Gould

Last week in Part One of this two-part series, I focused on how to increase the tax benefit of your charitable donations, enabling you to give more to charity at the same net cost. In this Part Two, I will review three other strategies for tax-smart charitable giving.

1 – Donating Appreciated Assets Instead of Cash

Reportedly, 88% of all donations are made in cash, including checks and credit cards. For many donors there’s a better way—giving highly appreciated assets such as stocks and mutual funds. You benefit whether you make donations directly to a charity or via a donor-advised fund (DAF).

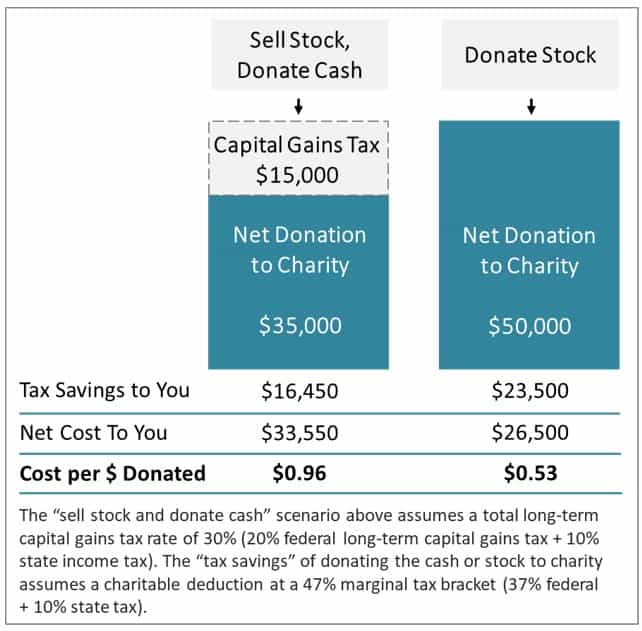

Suppose you were smart (or lucky) enough to buy stock in Amazon 20 years ago that you still own today. Almost 100% of the value of that stock is the increase since you purchased it. If you sold the stock today, say $50,000 worth, depending on your tax bracket you could easily pay 30% ($15,000) in capital gains tax to the IRS and the State of California, leaving you with $35,000 after tax.

The $35,000 cash donation gets you a tax deduction of $35,000, while the charity receives $35,000. If, instead of selling, you donate the stock, you get a tax deduction of $50,000 and the charity receives $50,000. (As a tax-exempt entity, the charity can sell the stock and owe no tax.) Donating the stock directly earns you a larger tax deduction and sends more to the charity, all by avoiding the capital gains taxes you would have paid had you sold the stock yourself. The accompanying chart Illustrates this.

If you think the stock you’ll donate remains a good investment, simply repurchase the same stock right after your donation. If you eventually sell the repurchased stock, your capital gains tax will be much lower because it will be based on the price you paid for the stock today, not 20 years ago.

2 – Qualified Charitable Distributions – A Gift to IRA Owners

Since 2006, people at least 70-1/2 years old have been able to make Qualified Charitable Distributions (QCDs) directly from their IRAs to charities. If you qualify, you can distribute up to $100,000 per year to your favorite charities. The distributions also count towards your required minimum distribution (RMD). (Note: QCDs must come from pre-tax IRA assets only, not from after-tax IRA or Roth IRA assets. Also, QCDs must go directly from your IRA to charities and cannot be made to a DAF.)

The QCD gives people who don’t itemize the same or even better tax benefits than taxpayers who itemize. That’s because QCDs are donations made with pre-tax dollars. For QCD-eligible taxpayers who do not itemize deductions, using the QCD for your charitable donations is a no-brainer.

Even if you itemize you could come out a bit ahead using the QCD instead of the traditional tax-deductible donation route. The QCD reduces your tax return’s top-line income, resulting in tax savings that are at least equal to and sometimes greater than the savings from a charitable deduction lower down on the tax return.

3 – Death and Taxes? Maybe Not So Certain

Every owner of a retirement plan—IRA, 401(k), 403(b), etc.—must name beneficiaries. Most people leave their retirement assets to their spouse and/or other immediate family members.

But if your estate plan includes bequests to charity, consider naming charities as beneficiaries of your retirement plans. When you leave your pre-tax IRA assets to charity, you are transferring funds that never have and never will be taxed. This may well be the lone exception to the adage that the only certain things in life are death and taxes.

Here’s why: With some exceptions such as Roth IRAs, most retirement plans are funded with pre-tax reductions in gross income, usually through a company retirement plan or direct contributions to an IRA. When tax-exempt charities receive your retirement plan assets, they do not pay tax. In other words, you have dollars of income that go untaxed from the day they are earned through the day they are used by your favorite charities. And they said it couldn’t be done.

In contrast, if you leave after-tax assets to charity and your retirement plan assets to family, your heirs will have to pay income tax on the distributions they must take from the retirement assets, and possibly also estate tax on their pre-tax value. While each situation is different and requires careful analysis, if you are planning to leave money to charity, naming charities as beneficiaries of your retirement plans deserves your consideration.

[This article provides general guidance. As with all tax matters, you should consult with your tax advisor before making tax-related decisions.]

Don Gould is president and chief investment officer of Gould Asset Management.