by Don Gould

Since December, US long-term interest rates have marched steadily upward, the result of a strong economy and Federal Reserve monetary tightening to combat inflation. As a result, bond prices fell in the first quarter of 2022. Rising market interest rates cause bond prices to fall, to keep their yields competitive with new bonds with higher yields.

Lower bond prices aside, higher interest rates hold a silver lining for most bond investors. If rates stay elevated from past levels, principal from maturing bonds will be reinvested at higher rates, locking in higher interest payments for the life of the replacement bonds. If your investment time horizon exceeds the average maturity of your bond portfolio, higher interest rates are good news over the longer term.

Here’s an analogy. Suppose you are taking a road trip from Claremont, California to Claremont, New Hampshire. You calculate that you will need six full tanks of gas to get there. You visit the gas station and fill your tank at a cost of $100. Just as you are about to set out on your journey, the cost of gasoline drops by half.

There are two ways to look at this development. First, you might be chagrined, knowing you could have saved $50 had you waited a bit longer to get that first tank of gas. True enough, but the much better news is that if gas stays at its new lower price, your next five tanks of gas will cost $250, not $500. You are still coming out way ahead.

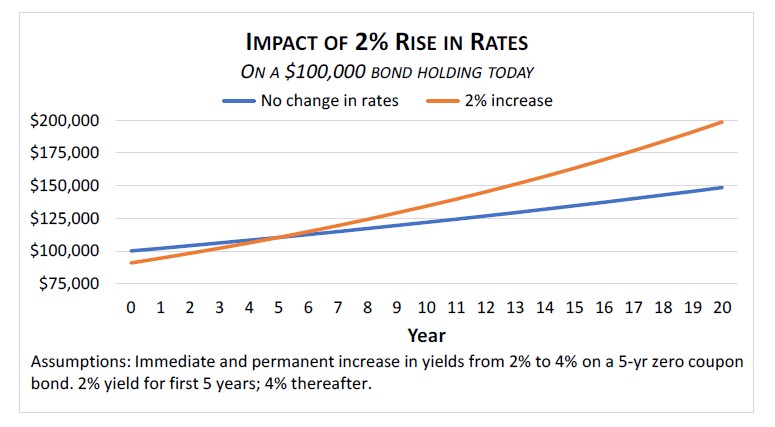

Think of your current bond portfolio as your first tank of gas. Yes, higher interest rates have diminished the value of what you hold today, just as your first tank of gas was devalued when the price of gas dropped. But the replacement bonds you purchase (as existing bonds mature and as interest is reinvested) will pay a higher interest rate. The accompanying chart shows how a 2% rise in market interest rates reduces the bond portfolio’s immediate value, but leads to a substantially higher value over time.

Don Gould is president and chief investment officer of Gould Asset Management.